Mortgage brokers gain ground in 2026 as rates hover near 6% and shoppers demand options

Mortgage brokers are seeing renewed momentum in early 2026 as borrowers chase small pricing edges and faster approvals in a housing market still constrained by affordability. With the average 30-year fixed mortgage rate sitting just above 6% in late January and volatility easing compared with prior years, more buyers and refinancers are focusing on total cost, lender overlays, and speed to close—areas where brokers can sometimes outcompete a single-bank approach.

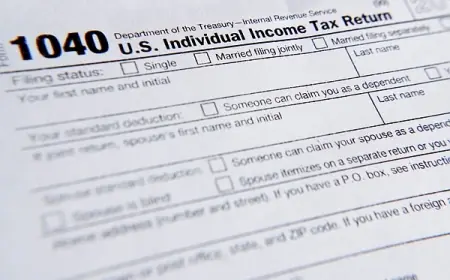

That shift is also colliding with tougher compliance expectations, more detailed state reporting, and a growing need for consumer education as borrowers compare “rate” versus “APR” and weigh points, buydowns, and different lock strategies.

Why mortgage brokers matter more when rates are “stuck” near 6%

When mortgage rates move quickly, borrowers often feel rushed and accept the first workable offer. When rates stabilize—even at a level many consider high—shopping behavior changes. Small differences in fees, credits, and points can meaningfully affect the monthly payment and cash-to-close, especially for first-time buyers. Brokers pitch a simple advantage: one application process that can be priced across multiple wholesale lenders.

In practice, brokers can be particularly useful for borrowers with:

-

self-employed or variable income,

-

condo or co-op properties with stricter underwriting,

-

jumbo loan needs near conforming limits,

-

tight contract timelines where “pre-underwritten” files help.

Brokers don’t always produce the cheapest deal, but they can surface alternatives when one lender’s rules or pricing don’t fit.

What “mortgage rates today” means for broker pricing

As of the weekly national survey released Thursday, Jan. 29, 2026 (12:00 p.m. ET), the average 30-year fixed rate was 6.10%, with the 15-year at 5.49%. Those averages are not what every borrower gets; they’re a broad market gauge based on standard borrower profiles. The practical point for broker clients is that “today’s rate” can vary meaningfully based on credit score, down payment, property type, occupancy, and whether the borrower pays points.

This is why broker conversations often shift from “what rate can you get me?” to “what does this option cost me, all-in?” A broker can quote multiple lenders side-by-side, but borrowers still need to compare the same lock period, the same points structure, and the same assumptions about escrow and credits.

A compliance squeeze: more reporting and tighter guardrails

The broker channel is also operating under increasing compliance pressure. State regulators continue to remind mortgage licensees about annual reporting obligations, and 2026 brings updated thresholds and consumer-disclosure expectations in several areas tied to credit reporting and lending rules.

For brokers, the operational impact is straightforward:

-

stronger documentation discipline,

-

clearer fee explanations on the Loan Estimate,

-

careful handling of marketing claims around “guaranteed” rates or approvals,

-

more attention to privacy and cybersecurity in borrower-document collection.

This matters for consumers because the difference between a smooth, on-time closing and a painful delay often comes down to how cleanly the file is assembled and how well conditions are managed.

How borrowers should evaluate a mortgage broker in 2026

The “best” broker is rarely the one who promises the lowest headline rate first. The strongest brokers tend to communicate tradeoffs clearly and price options transparently.

Key takeaways for shopping brokers

-

Ask for 2–3 scenarios on the same day: with points, without points, and a different lock length.

-

Compare APR and total cash-to-close, not just the interest rate.

-

Confirm who your loan will be submitted to and how many lenders the broker can realistically price for your profile.

A simple test: if you can’t get a clear explanation of compensation, credits, and lock terms up front, the process usually gets harder later.

What to watch next: refinancing waves and policy-driven rate moves

Mortgage activity can shift quickly if rates drift even modestly lower. Early 2026 has already shown how a small move in rates can trigger a notable rise in refinancing interest, while purchase demand remains sensitive to home prices and inventory.

For brokers, the near-term opportunity is in being “ready for the wave”: building systems that can handle higher volume without sacrificing accuracy. For borrowers, the opportunity is preparation: documents organized, credit checked, and a clear sense of budget—so when a workable rate appears, the decision is faster and less stressful.

Sources consulted: Freddie Mac, Consumer Financial Protection Bureau, California Department of Financial Protection and Innovation, Reuters