Kevin Warsh named as Trump’s Fed chair pick to succeed Jerome Powell

President Donald Trump’s fed chair announcement on Friday, Jan. 30, 2026, put kevin warsh at the center of U.S. economic policy and market volatility, with traders quickly repricing expectations for interest rates, the dollar, and the silver price. The move answers a question that’s been hanging over the federal reserve for months: whether jerome powell—the current federal reserve chairman and fed chair powell—would be followed by a continuity pick or a sharper policy pivot.

Trump said he intends to nominate Warsh as the new fed chair, setting up a Senate confirmation fight that will run alongside fresh scrutiny of Fed governance and ongoing market nerves in precious metals and crypto.

Trump announcement today and what it changes

The White House signaled the decision late Thursday, then trump announcement today confirmed the choice early Friday morning in a social-media post. The nomination would make Warsh the next fed chair once Powell’s current chair term expires—assuming the Senate votes to confirm.

This is not an immediate replacement. In practical terms, the Fed’s day-to-day policy remains in Powell’s hands through the end of his chairmanship, including communications around inflation, the labor market, and balance-sheet policy. But markets treat a chair-designate as “real information,” especially when the incoming leader has well-known preferences on rates and the size of the central bank’s bond holdings.

Warsh was selected over other finalists who had been publicly discussed for months, including kevin hassett, the White House’s top economic adviser, as well as other names that circulated in financial circles. The nomination also lands amid heightened political pressure on the institution’s independence, which could become a central theme of the confirmation hearing.

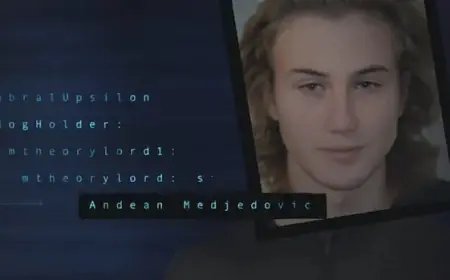

Who is Kevin Warsh?

If your feed is filling with “who is kevin warsh,” here’s the core résumé. Warsh previously served as a Federal Reserve governor from 2006 to 2011, a period that included the 2008 financial crisis, and he became a prominent liaison between the central bank and Wall Street during the most acute phases of the turmoil. After leaving the Fed, he remained a frequent public commentator on monetary policy, often criticizing the central bank’s post-crisis reliance on large-scale asset purchases and an expanded balance sheet.

Warsh has lately signaled openness to rate cuts, even while arguing that the Fed’s balance sheet should be smaller and that policymaking should be more constrained and more clearly tied to the institution’s statutory mandate. That mix—easier rates, tighter balance-sheet posture—is one reason markets have treated the pick as neither purely “dovish” nor purely “hawkish.”

One quick cleanup: some posts and search queries have misspelled the name as kevin walsh fed. The nominee is Kevin Warsh.

When does Jerome Powell’s term end?

Two dates matter, and they often get conflated in searches like jerome powell term end and when does jerome powell's term end.

Powell’s chair term ends May 15, 2026. Separately, Powell’s term as a member of the Fed’s Board of Governors runs to Jan. 31, 2028, meaning he could remain on the board even after no longer serving as chair.

So, is jerome powell being replaced? Politically, Trump is trying to replace him as chair. Legally and operationally, Powell remains the sitting chair until the end of his chair term (or until a confirmed successor is in place), and his governor term extends beyond that.

Silver price swings as markets digest the pick

The Fed-chair news hit an already overheated precious-metals market that has been whipsawing after a huge January run-up. Silver fell sharply Friday as the dollar firmed and traders locked in gains.

Spot silver snapshot (9:09 a.m. ET, Jan. 30, 2026)

| Measure | Level | 24h move |

|---|---|---|

| Silver spot (USD/oz) | $98.84 | -$17.71 (approx. -15.1%) |

The bigger story is the reversal from the prior day’s surge near the $120 area: after a month of rapid appreciation, Friday looked like a classic “air pocket” move—thin liquidity, crowded positioning, and fast profit-taking once a new macro catalyst arrived.

Crypto angle: “kevin warsh crypto” and risk sentiment

The phrase kevin warsh crypto has been trending alongside the Fed-chair headlines, partly because crypto trades as a macro-sensitive asset when rate expectations and liquidity conditions shift. In the hours around the nomination, bitcoin and related risk assets wobbled as traders weighed whether a Warsh-led Fed would be quicker to cut rates, stricter on shrinking the balance sheet, or both.

Warsh’s public comments over time have been read in different ways: less dismissive of digital assets than some Fed leadership rhetoric, but not an obvious “easy money” signal either. For crypto markets, the near-term driver is still the same: how the Fed communicates the path of inflation and the timing and pace of any easing.

What happens next for the Federal Reserve

The nomination now moves to the Senate, where timing matters as much as votes. A smooth process could allow a confirmed successor to be ready as Powell’s chair term concludes in mid-May. A contentious process could stretch longer, leaving uncertainty over leadership at a moment when markets are already sensitive to policy signals.

For investors, the key watchpoints are straightforward: (1) the tone of Warsh’s confirmation testimony on independence and balance-sheet policy, (2) how sitting Fed officials respond publicly—if at all—and (3) whether the dollar, yields, and commodities stabilize after the initial repricing.

Sources consulted: Reuters, The Associated Press, Financial Times, The Washington Post, Federal Reserve History, Congressional Research Service