Gold price today slips from record highs as profit-taking hits after a historic January surge

The gold price today is easing after a blistering rally pushed bullion to fresh records earlier this week, with traders shifting from “buy the fear” to “lock in gains” as January closes out. In late Thursday trading and into early Friday, January 30, 2026 ET, spot gold hovered around $5,330 per ounce, down from an intraday record near $5,595 reached during the recent spike.

Even with the pullback, gold is still finishing the month with one of its strongest performances in decades, underscoring how quickly the market has re-priced risk across currencies, geopolitics, and interest-rate expectations.

Gold price today: where it’s trading and what changed in the last 24 hours

Gold’s latest move is less about a sudden reversal and more about exhaustion after a near-vertical climb. The market ran hard into the record, then began to wobble as short-term traders took profits and volatility jumped across precious metals.

A simple way to read the tape:

-

Spot gold: around $5,330 per ounce in recent trading

-

Recent record: around $5,595 per ounce during the week’s surge

-

Momentum: still strongly positive on a monthly basis, despite the daily dip

For consumers who track jewelry pricing, that spot level roughly translates to about $171 per gram for pure gold, before retail markups and local taxes.

What’s behind the headline: why gold surged first, then slipped

Gold’s run-up has been fueled by a rare alignment of forces that all push the same direction: demand for safety, doubts about the durability of growth, and expectations that interest rates may fall later in 2026.

The pullback is being driven by a different set of incentives:

-

Profit-taking after a record: When a market makes a fresh high quickly, a portion of buyers become sellers simply to secure gains.

-

Crowding risk: Big, fast rallies attract momentum traders. When the move pauses, those same positions can unwind rapidly.

-

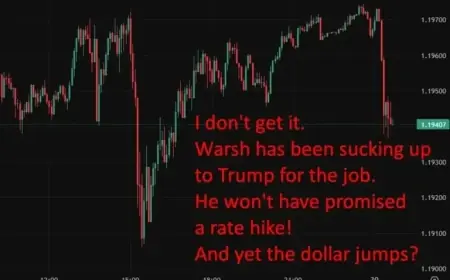

Shifting rate expectations: Gold tends to like falling yields and a softer dollar. Any wobble in those expectations can trigger a quick reset.

The key point is that none of those forces require the long-term gold story to “break.” They just create air pockets after a sprint.

Who wins and who loses when gold moves like this

The stakeholders around gold are broader than most people realize:

-

Households and jewelry buyers face higher prices and often pull back unless local currency weakness makes gold feel like protection.

-

Central banks and reserve managers gain a liquid hedge, but also face political questions when gold allocation grows too fast.

-

Miners benefit from higher realized prices, though costs can rise in parallel if energy and labor tighten.

-

Investors split into two camps: long-term holders who see gold as insurance, and short-term traders who treat it like a high-volatility momentum asset.

This month has rewarded both groups, but the latest pullback shows how quickly the “trader” cohort can amplify moves in both directions.

What we still don’t know: the missing pieces that could decide February’s direction

Despite the dramatic rally, several uncertainties remain unresolved:

-

How long geopolitical stress stays elevated: Gold’s biggest spikes often coincide with headlines that are hard to model.

-

Whether the dollar keeps weakening: A sustained currency trend can keep gold supported even when risk appetite returns.

-

How soon rate cuts become “real” rather than “expected”: Markets can price easing for months. The actual shift is what tends to lock in a new range.

-

Whether physical demand catches up with financial demand: If investor-driven buying gets ahead of real-world consumption, prices can overrun the near-term fundamentals.

Second-order effects: why today’s gold price matters beyond the metals market

A gold move of this magnitude doesn’t stay contained.

-

Inflation psychology: Even if consumer inflation is stable, surging gold can reinforce a public sense that money is losing purchasing power.

-

Currency stress signals: In many countries, rising local gold prices track anxiety about exchange rates and capital controls more than jewelry demand.

-

Portfolio reshuffling: When gold performs this well, investors often rebalance by trimming equities or reallocating within “real asset” buckets, which can affect broader market flows.

-

Policy pressure: Big gold moves tend to intensify political pressure on central banks, especially if the public reads bullion strength as a warning sign.

What happens next: realistic scenarios and the triggers to watch

-

Gold consolidates near recent highs

Trigger: yields stay contained and the dollar remains soft, keeping dips shallow. -

A deeper pullback toward a new “support” range

Trigger: risk appetite returns sharply, or rate-cut expectations get pushed out. -

Another leg higher and new records

Trigger: renewed geopolitical shocks or a decisive shift toward easier monetary policy. -

A volatile sideways market

Trigger: mixed economic data that keeps traders flipping between “recession hedge” and “risk-on” narratives.

Gold’s latest dip doesn’t erase the bigger story: the market is still pricing a world where uncertainty is persistent and hedges are back in demand. The next few weeks will test whether January’s surge becomes a new base—or a peak that needs time to cool.