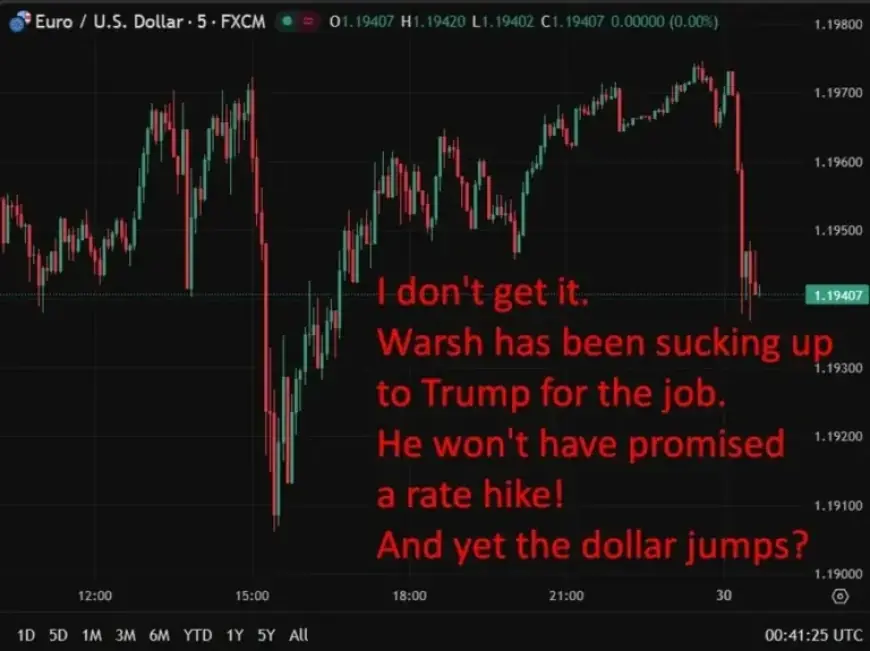

USD Surges on Speculation: Kevin Warsh Poised as Fed Chair, Announcement Friday

As speculation mounts, the U.S. dollar has strengthened ahead of a significant announcement regarding the next Federal Reserve chair. President Donald Trump is set to reveal his choice on Friday, January 30. Former Federal Reserve governor Kevin Warsh has emerged as the leading candidate following a recent meeting with the President.

Market Reactions to Warsh’s Candidacy

Betting markets have swiftly adjusted their odds, reflecting Warsh’s increasing candidacy likelihood. According to Kalsi, the probabilities suggest a significant shift in favor of Warsh, particularly after reports indicated he has received favorable signals from Trump.

Key Candidates and Speculations

While Warsh is the frontrunner, Kevin Hassett is reportedly out of contention. Rick Rieder remains in the running, having been seen at the White House. The dynamics surrounding these candidates raise questions regarding the Federal Reserve’s future direction.

- Leading Candidate: Kevin Warsh

- Other Finalists: Rick Rieder, formerly Kevin Hassett

Potential Implications for the Federal Reserve

Warsh’s potential appointment could significantly impact the Federal Reserve’s policies. He has been a known critic of ultra-loose monetary policy and is perceived as more hawkish compared to the current chair, Jerome Powell. This perspective has sparked debate over the future approach to inflation control and financial conditions under Warsh’s leadership.

Market Sentiment and Economic Outlook

With inflation continuing to exceed the target, many investors are closely monitoring the situation. The outcome of this appointment could hold immediate consequences for Treasury yields, the U.S. dollar, and overall market sentiment.

As Friday’s announcement approaches, the rising odds for Warsh signal how seriously investors are considering the potential for a shift in monetary policy direction at the Federal Reserve.