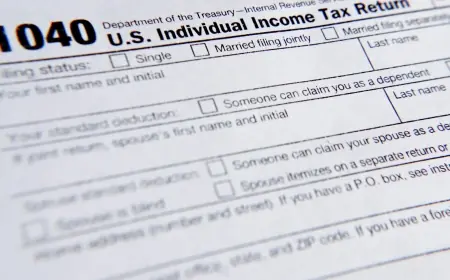

Mortgage Rates Today: 30-Year Fixed Near 6.05% as Borrowers Gauge the Fed’s Pause and the Next Data Shock

Mortgage rates are holding in a narrow band on Thursday, January 29, 2026 ET, with the widely watched 30-year fixed-rate conforming loan sitting near the low 6% range. The key takeaway for homebuyers is not a dramatic move up or down, but a continuation of the same affordability squeeze: rates have eased from last year’s highs, yet they remain elevated enough to keep monthly payments stubbornly heavy.

A large dataset tracking recently locked loans shows the average 30-year fixed conforming rate at 6.051%. That is roughly flat versus the prior day and modestly lower than a week earlier. The same dataset puts the 15-year fixed at 5.415%, underscoring the familiar trade-off: lower interest costs over time, but much higher monthly payments.

Mortgage rates today snapshot, January 29, 2026 ET

Here’s a quick look at common loan types based on recently locked-rate averages:

-

30-year conventional conforming: 6.051%

-

15-year conventional conforming: 5.415%

-

30-year jumbo: 6.394%

-

30-year FHA: 5.923%

-

30-year VA: 5.688%

-

30-year USDA: 5.949%

These are averages, not guarantees. Your quote can differ based on credit score, down payment, debt-to-income ratio, property type, and whether you pay points.

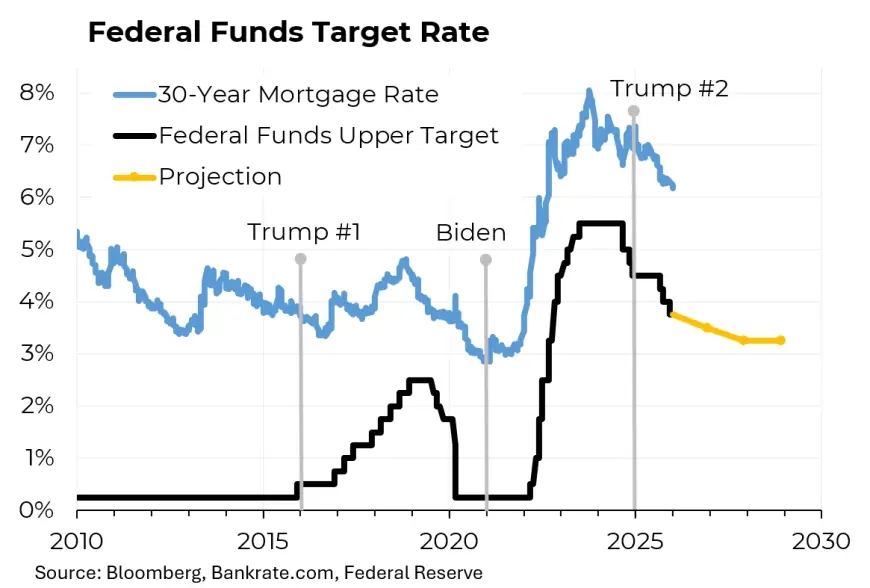

Why mortgage rates aren’t falling faster

Mortgage rates don’t move in lockstep with the Federal Reserve, but the Fed still sets the mood in the bond market. On Wednesday, January 28, 2026 ET, the Fed held its policy rate steady, reinforcing the message that it wants more evidence inflation is truly under control before moving again.

That matters because 30-year mortgages are priced off longer-term market rates and investor demand for mortgage-backed securities. When investors demand higher yields to hold long-duration assets, mortgage rates resist falling even if the Fed stops tightening. When investors gain confidence that inflation and growth are cooling, yields can drift down and mortgage pricing follows.

Right now, the market looks conflicted: growth hasn’t cracked, inflation progress is uneven, and investors still want compensation for uncertainty. The result is a “sticky” mortgage-rate range near 6%.

Behind the headline: the incentives driving today’s pricing

This rate plateau is a tug-of-war among competing incentives:

-

Lenders want volume, but they also want margin. When demand is fragile, lenders can compete on rates, but only within the constraints of secondary-market pricing.

-

Bond investors care about inflation risk, prepayment risk, and volatility. If rates fall too quickly, refinances spike and investors get paid back early, reducing returns. That risk can keep mortgage-backed yields elevated.

-

Homebuyers want any drop they can get, yet many are forced to choose between compromising on home price, location, or timing.

-

Sellers remain influenced by the lock-in effect: homeowners with older, much lower mortgage rates often hesitate to list, constraining supply and keeping prices firm even when demand softens.

-

Builders are incentivized to use workarounds such as rate buydowns and incentives to move inventory without cutting headline prices too aggressively.

The system has settled into a new equilibrium: fewer transactions, tight existing-home supply, and builders acting as the “shock absorber” through incentives.

What we still don’t know

The next meaningful move in mortgage rates will likely need a clear trigger, and several big ones are still unresolved:

-

How the labor market prints next month: The Employment Situation report for January is scheduled for Friday, February 6, 2026 at 8:30 a.m. ET. A weaker-than-expected jobs picture tends to pull long-term yields down, which can help mortgage rates.

-

Whether inflation keeps cooling or re-accelerates: One or two firm readings can keep yields elevated even if the Fed stays on hold.

-

Whether mortgage-backed security spreads narrow: Even if Treasury yields drift down, mortgage rates can remain stubborn if spreads stay wide due to volatility or weak demand for mortgage bonds.

-

How policy uncertainty affects markets: Fiscal negotiations, geopolitical risk, and shifting trade expectations can all move bond yields quickly, and mortgages often react in real time.

What happens next: scenarios and triggers for rates

Mortgage rates are close enough to a psychological threshold that small changes can alter behavior. Here are realistic paths from here:

-

Rates grind lower toward the high 5% range

Trigger: softer job growth and clearer inflation cooling that nudges long-term yields down. -

Rates stay range-bound around 6%

Trigger: mixed economic data that keeps investors unwilling to commit to a clear direction. -

Rates jump back toward the mid 6% range

Trigger: hotter inflation data, a growth surprise, or a risk event that pushes yields higher. -

Purchase rates slip, but refinance stays quiet

Trigger: modest declines that help new buyers at the margin but don’t beat most homeowners’ existing rates by enough to justify refinancing.

Why this matters for your monthly payment

At a 30-year fixed rate of about 6.1%, the principal-and-interest payment is roughly $606 per month for each $100,000 borrowed. At 6.0%, it’s about $600 per month per $100,000. That difference sounds small, but on a $400,000 loan it’s roughly $26 per month for a tenth of a percentage point, and it adds up when rates move by a quarter point or more.

For now, mortgage rates today are less about a headline plunge and more about patience, timing, and strategy: shopping multiple offers, weighing a lock versus floating, and deciding whether the home itself is worth the current cost of money.