IRS Refund Status Checks Spike as 2026 Filing Season Opens and Early Refund Timelines Take Shape

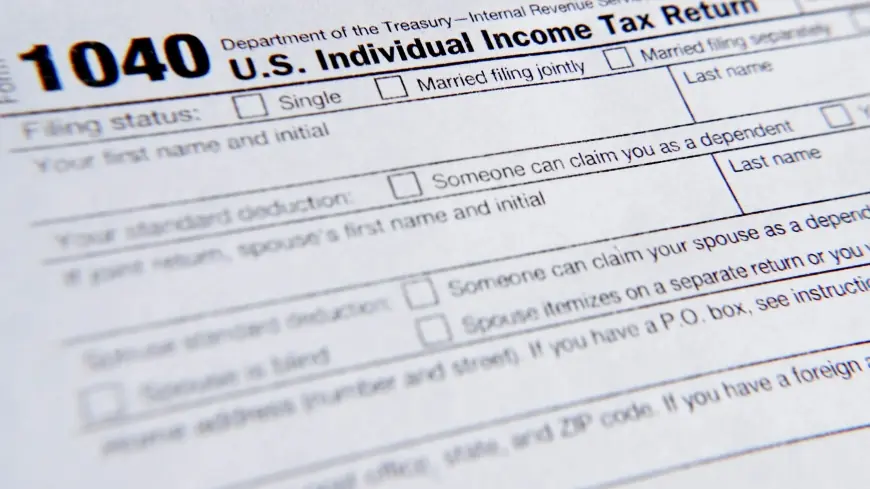

IRS refund status searches are surging as the federal filing season gets underway and millions of taxpayers start tracking when their money will arrive. The Internal Revenue Service began accepting individual income tax returns for the 2025 tax year on Monday, January 26, 2026, with the standard filing deadline set for Wednesday, April 15, 2026, in Eastern Time.

For many filers, the first question after hitting submit is the same: when will the refund tracker move from “received” to “approved” to “sent,” and what does it mean when it doesn’t.

Filing season opens, and the refund tracker becomes the first stop

The IRS says refund tracking typically becomes available quickly for electronic filers. For a current-year return filed electronically, a refund status can appear about 24 hours after the return is accepted. Paper filers generally wait much longer, with the first status often not showing up for about four weeks.

The agency also emphasizes that most refunds are issued within 21 days for e-filed returns, while returns sent by mail can take six weeks or more. Amended returns follow their own clock and can take weeks to appear in the system and significantly longer to process.

Further specifics were not immediately available about how closely this season’s real-world averages will match the typical timelines across all regions and return types, especially as early-season volumes build.

Mid-February matters for EITC and Additional Child Tax Credit filers

A major exception shapes a big share of early refund anxiety: refunds tied to the Earned Income Tax Credit and the Additional Child Tax Credit are legally delayed. If a taxpayer claims either credit, the IRS cannot issue the refund before mid-February, and the hold applies to the entire refund, not just the portion linked to the credit.

The IRS has also provided a clearer expectation point for early filers in that category. For most early EITC and Additional Child Tax Credit filers, the refund tracker should show an updated status by Friday, February 21, 2026, Eastern Time. The agency says taxpayers in that group can expect to receive their refunds by Monday, March 2, 2026, Eastern Time if they filed online, chose direct deposit, and the IRS found no issues with the return.

Some specifics have not been publicly clarified about how many taxpayers will fall outside that March 2 target because of additional review, verification steps, or bank processing delays.

Why your IRS refund status updates feel slow

There’s a simple reason “checking again” often doesn’t help: the IRS updates its main refund tracker once a day, usually overnight. The tool is also generally unavailable each morning between about 4 a.m. and 5 a.m. Eastern Time while updates run. In other words, a taxpayer can refresh all day and still see the same message until the next overnight update.

Mechanically, refunds move through a pipeline that starts with basic acceptance checks, then processing and validation steps, and finally authorization of payment. Once a refund is marked “sent,” direct deposits may still take a few days to appear in a bank account depending on the institution’s processing schedule, weekends, and holidays. Paper checks, when issued, typically take longer and are subject to mailing time.

The IRS also notes that refunds can be delayed by errors, missing information, suspected identity theft or fraud screening, and cases where the agency needs more information and sends a letter.

Who is most affected and what filers are doing next

The timing matters most for two groups in particular: households relying on refundable credits like the Earned Income Tax Credit and the Additional Child Tax Credit, and families expecting refunds to cover near-term bills, rent, childcare, or debt payments. Tax preparers and volunteer filing clinics are also impacted because delays often translate into higher call volumes and more follow-up questions from clients who assume something went wrong when a status sits still for days.

Banks and payroll card providers can feel the ripple effects, too, since refund timing influences overdraft risk, account activity spikes, and customer service demand once “refund sent” appears but the deposit is not yet visible.

The next milestone for many early filers is the mid-to-late February status change window, especially Friday, February 21, 2026, Eastern Time, when the IRS expects most early EITC and Additional Child Tax Credit filers to see an updated tracker status, followed by the Monday, March 2, 2026, Eastern Time target for refunds that clear without issues and go by direct deposit.