IBM Stock Jumps After Earnings Beat as Software and AI Momentum Lift 2026 Outlook

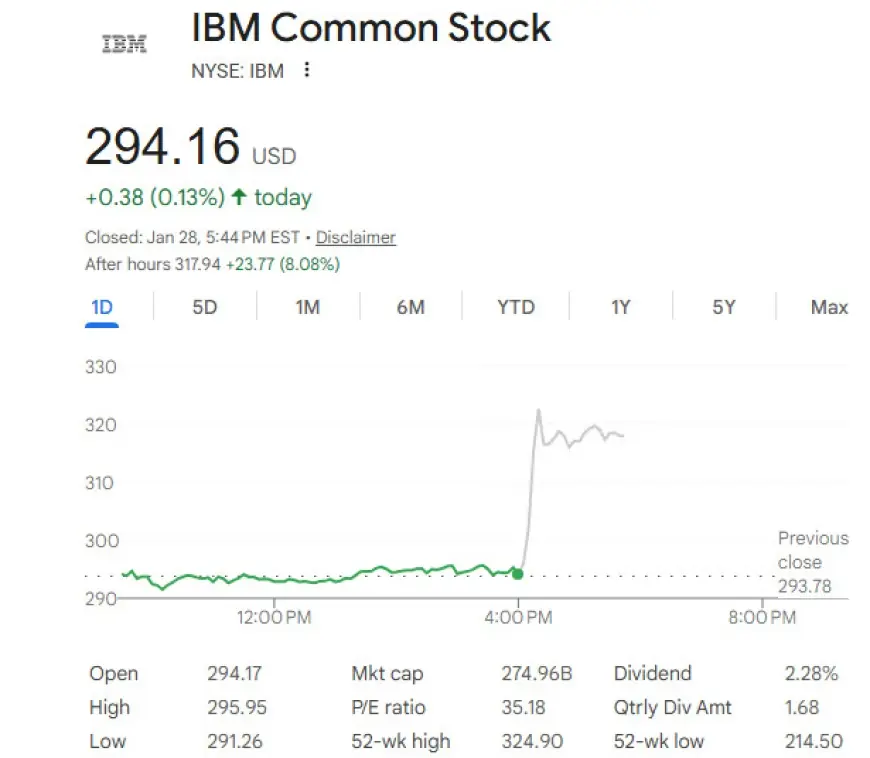

IBM stock was in focus Wednesday after the company posted a stronger-than-expected quarter and offered an upbeat view for 2026, fueled by software demand tied to enterprise AI projects. IBM shares traded around the mid-$290s during regular hours before popping in extended trading as investors digested the results and guidance.

IBM’s update lands at a time when markets are rewarding large-cap tech names that can show durable recurring revenue, clear cash generation, and credible AI monetization rather than one-off experimentation.

IBM earnings: Revenue and profit top expectations as software leads

IBM reported fourth-quarter revenue of about $19.7 billion, up roughly 12% from a year earlier, and adjusted earnings per share of $4.52. Software was the primary engine, with segment revenue around $9.0 billion for the quarter, while consulting revenue was about $5.35 billion and infrastructure was about $5.1 billion.

The company highlighted continued traction in its generative AI offerings, putting its “AI book of business” at more than $12.5 billion for the quarter. That figure has become a closely watched proxy for how much real paid work is landing behind the AI narrative.

Not every line item was uniformly strong. Consulting growth was more modest, and one key hybrid cloud area showed slower growth than earlier in the year, reflecting how enterprise spending can shift as customers prioritize longer, more complex AI modernization projects.

Some specifics have not been publicly clarified about the exact composition of the AI book of business across software, consulting, and infrastructure. Further specifics were not immediately available on how much of the quarter’s demand was pulled forward versus newly budgeted for 2026.

IBM stock price today: Mid-$290s trading, then an after-hours pop

IBM stock price action reflected the classic “beat and raise” pattern. Shares hovered around $294 in regular trading, then moved higher in extended hours after the earnings release, with the after-hours jump broadly in the mid- to high-single digits as the market reacted to the combination of stronger results and a confident outlook.

Intraday moves around earnings can be noisy, especially because trading volumes often spike and price swings can widen outside regular market hours. That’s also when investors recalibrate positions quickly based on headlines, guidance language, and early read-throughs on segment strength.

How IBM earnings move the stock: Guidance, cash flow, and the AI test

Earnings reports typically move a stock less on what just happened than on what management signals about what happens next. Investors compare reported results to expectations, but the bigger driver is often forward guidance: revenue growth, margin direction, and free cash flow.

For IBM, the mechanism is straightforward. A larger share of its business is built on recurring software and subscription-like revenue, which tends to be valued more highly when growth holds up. When IBM can show software acceleration while keeping cash flow strong, it supports the case that the company’s pivot toward higher-margin offerings is working. In AI, markets are also looking for evidence of repeatable enterprise spending rather than short-lived pilot projects, so metrics that imply contracted work and deployments matter.

IBM’s outlook for 2026 called for more than 5% revenue growth in constant currency and about $1 billion more free cash flow year over year, framing the year as one of continued momentum rather than a pause after a strong finish. IBM also declared a quarterly dividend of $1.68 per share, payable March 10 to shareholders of record Feb. 10, reinforcing the company’s emphasis on shareholder returns alongside investment.

Who’s impacted: Investors, enterprise customers, and employees

Two groups feel the impact most directly. First are investors, including retirement savers and income-focused holders, because guidance and cash flow expectations influence not just near-term price moves but also dividend confidence and valuation assumptions. Second are enterprise customers, who watch IBM’s results for signals about product investment, pricing power, and long-term support for platforms they run at scale.

Employees are another key stakeholder. Strong software demand and AI-related bookings can mean continued hiring and investment in priority areas, even as large tech companies regularly rebalance teams and spending to match where growth is strongest.

The next milestone will be IBM’s next quarterly earnings release and conference call, when the company reports first-quarter 2026 results and updates its full-year outlook—likely the clearest near-term test of whether software strength and AI demand are holding into the new year.