Microsoft’s Capital Spending Surges; Revenue Disappoints, Shares Fall After Hours

Microsoft has reported soaring capital expenditures but disappointing revenue growth, leading to a significant drop in its stock price. Following the release of its latest quarterly results, Microsoft’s shares fell more than 7% in after-hours trading.

Record Capital Spending

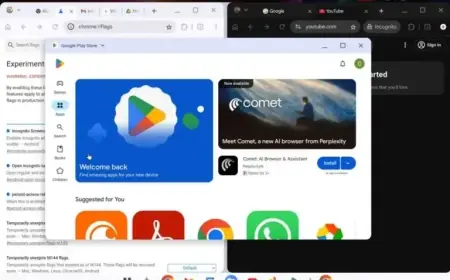

In the second fiscal quarter, Microsoft announced a record capital spending of $37.5 billion. This represents an increase of nearly 66% from the same period last year. Approximately two-thirds of this expenditure was allocated towards computing chips, surpassing market estimates of $34.31 billion.

Revenue Insights

Despite capital expenditures reaching new heights, Microsoft’s revenue growth only slightly outpaced expectations. Total revenue rose by 17% to $81.3 billion, just above the anticipated $80.27 billion. Notably, the Azure cloud division reported a revenue increase of 39%, marginally exceeding the consensus estimate of 38.8%.

Concerns Over Market Competition

The competition in the AI space has intensified, particularly with the recent introduction of Google’s Gemini model and other advanced AI products. Analysts express concerns that these developments may hinder Microsoft’s growth and market position in artificial intelligence.

Dependence on OpenAI

- Microsoft currently holds a 27% stake in OpenAI.

- Approximately 45% of Microsoft’s cloud backlog is influenced by OpenAI.

- OpenAI plans to spend around $1.4 trillion on AI development.

This reliance underscores Microsoft’s vulnerability, as OpenAI also looks to establish deals with other cloud service providers. The recent restructuring at OpenAI included a commitment to purchase $250 billion in Azure services, providing both opportunities and risks for Microsoft.

Future Outlook

Investors remain cautious about whether large-scale investments in AI will deliver sufficient returns. Microsoft’s expanding backlog in the cloud business, which has doubled to $625 billion, indicates robust demand, yet reliance on OpenAI gives rise to uncertainties regarding sustained growth.

As Microsoft navigates these challenges, its stock performance will likely continue to hinge on the evolving dynamics of the AI landscape.