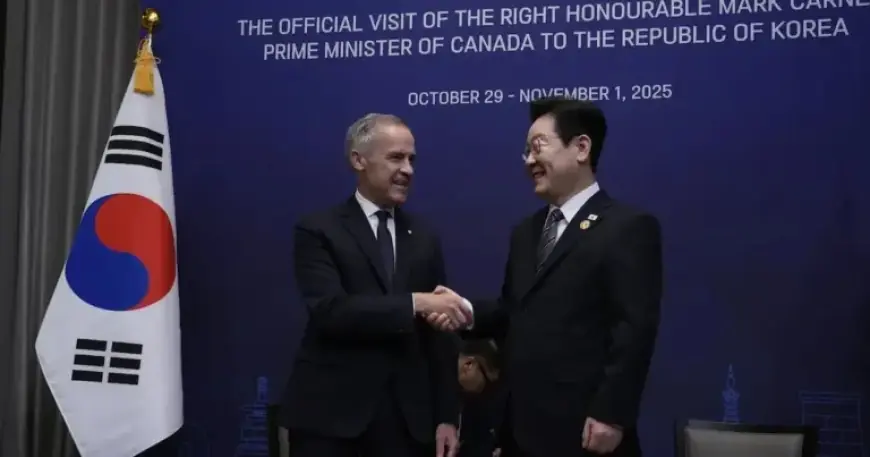

Canada and South Korea Discuss Auto Manufacturing Partnership: Sources

The Canadian federal government has entered into a memorandum of understanding (MOU) with South Korea. This agreement aims to foster collaboration in the auto manufacturing sector. The MOU was signed by Industry Minister Melanie Joly and South Korean Minister Jung-Kan Kim during their recent meeting in Ottawa.

Details of the Canada-South Korea Auto Manufacturing Partnership

Although not legally binding, the MOU outlines plans for enhanced industrial cooperation, focusing on the future of mobility. The discussions are still in preliminary stages, encompassing the production of vehicles, auto parts, and batteries.

Key Personalities Involved

- Melanie Joly – Canadian Industry Minister

- Jung-Kan Kim – South Korean Industry Minister

- Flavio Volpe – President of the Automotive Parts Manufacturer’s Association (APMA)

- Glenn Copeland – CEO of Hanwha Canada

Context of the Cooperation

This partnership stems from South Korea’s ambition to secure a contract to replace Canada’s aging submarines. Notably, Hyundai and Hanwha Ocean were part of the South Korean delegation involved in discussions aimed at expanding automotive manufacturing in Canada. During a Canada-Korea auto forum in Toronto, Canadian executives engaged with Hyundai representatives about potential manufacturing operations in Canada.

Market Position and Growth Potential

Currently, Korean automakers hold approximately 12 percent of the Canadian automotive market. Volpe highlighted that now is an ideal time for the Canadian government to leverage defense spending to bolster the auto industry.

“The business case exists to establish a plant for electric vehicle production in Canada,” Volpe stated, emphasizing the alignment of local manufacturing with consumer demand.

Submarine Contract and Economic Impact

The South Korean firms are competing against German contractor TKMS for a submarine contract potentially valued at $100 billion over the next 30 to 40 years. The Canadian government has stipulated that these competitors must provide industrial benefits to essential sectors, including automotive, steel, and aluminum.

Investment in Canadian Infrastructure

During the auto forum, Hanwha announced five new MOUs with Canadian partners, focusing on integrating local technology and products into submarine building. Key investments from Hanwha include:

- $275 million towards constructing a new steel beam mill in Sault Ste. Marie, Ontario.

- $70 million for steel procurement from Algoma for submarine construction and development facilities planned in Nova Scotia and British Columbia.

Hanwha’s strategy aims to create an estimated 15,000 jobs in Canada through partnerships with 21 Canadian companies. This development comes after Algoma Steel laid off 1,000 employees, highlighting the potential for job restoration through new projects.

Future Prospects

Hanwha plans to enhance its presence in the Canadian defense sector, opening an office in Ottawa in February. Copeland voiced confidence in securing the submarine contract, calling the synergy with Canada’s defense needs evident. Canada aims to commit 5 percent of its GDP to defense spending by 2035, translating to an estimated annual cost of $150 billion.

The collaboration between Canada and South Korea in the auto manufacturing sector and defense projects indicates promising developments for both countries.