Trump Administration Expands Investment in Rare Earth Industry

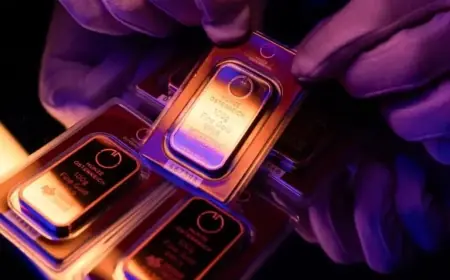

The Trump Administration has recently taken significant steps to bolster the rare earth industry. An agreement has been reached to provide up to $277 million in direct funding along with up to $1.3 billion in loans to USA Rare Earth Inc. This initiative aims to enhance the domestic supply chain for essential rare earth metals and magnets.

Investment Details

This deal represents a noteworthy expansion of the administration’s investment strategy, which now includes equity stakes in various private firms. The funding will aid in the production of critical materials used in a range of products, from electric vehicles to semiconductors.

Context of the Investment

This investment comes at a time when China has tightened its grip on the rare earth supply chain, impacting global availability. The Commerce Department facilitated this financing through a semiconductor investment program initiated under the Biden Administration.

Funding Breakdown

- Direct funding: Up to $277 million

- Loans: Up to $1.3 billion

- Estimated shares received: 16 million

- Warrant for additional shares: 17.6 million

Significance of USA Rare Earth Project

According to Howard Lutnick, the Secretary of Commerce, the project is crucial for restoring U.S. critical mineral independence. This investment is anticipated to make U.S. supply chains more resilient and less reliant on foreign resources.

Future Production Plans

USA Rare Earth is projected to commence commercial production at a Texas mine by 2028. Additionally, a manufacturing project will be established in Oklahoma. It is poised to become the only U.S. company capable of mining rare earth minerals and converting them into feedstock for magnets.

Controversy and Ethical Scrutiny

The involvement of Cantor Fitzgerald in this deal has raised ethical concerns. The Wall Street firm was previously led by Secretary Lutnick and is now run by his sons. Critics argue that this connection prompts questions about the prioritization of public interests over private profits.

Criticism from Watchdog Groups

Robert Weisman of Public Citizen expressed concerns about potential conflicts of interest. He remarked that the association between the firm and the Commerce Secretary raises alarms about the subordination of public well-being to the interests of Trump associates.

Broader Investment Strategy

The Trump Administration has now committed to equity stakes in at least ten private companies, primarily within the metals and mining sectors. This approach aims to secure strategic autonomy from China.

Other Notable Investments

Alongside USA Rare Earth, the administration has also allocated investments to:

- Chipmaker Intel

- Nuclear firm Westinghouse

- U.S. Steel

While some argue that these investments distort the private market, the administration contends they provide greater benefits to American taxpayers when these companies thrive.