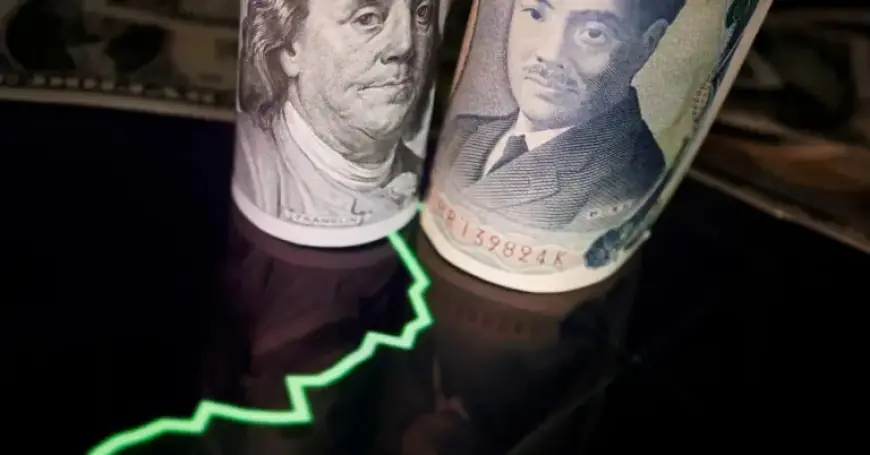

NY Fed Conducts Dollar/Yen Rate Checks, Source Reports

The New York Federal Reserve has recently conducted rate checks involving the dollar/yen currency pair, as per an informed source. This event occurred around midday on January 20, 2023, and has raised eyebrows among financial analysts.

Impact of Rate Checks on Currency Value

Following the rate checks, the U.S. dollar experienced a notable decline. Initially trading at approximately 157.50 yen, the dollar fell to 155.66 yen by the afternoon, marking a four-week low. Ultimately, it closed down 1.6% at 155.85 yen.

Monetary Policy Signals

- The NY Fed acts as the fiscal agent for the U.S. Treasury.

- Rate checks can indicate potential monetary intervention from authorities.

- Traders remain cautious about possible intervention, especially as the yen approaches the 160 per dollar level.

Market analysts suggest that these actions may signal an impending response from both U.S. and Japanese monetary authorities. Such a move comes after a prolonged period of dollar strength against the yen.

What Are Rate Checks?

Rate checks involve monetary officials querying dealers about potential market prices. This practice serves as a precursor to possible market intervention, providing insight into the authorities’ readiness to act.

Future Monitoring

The Bank of Japan is expected to release pertinent data on January 23, 2023, at 1800 JST (0900 GMT). Analysts will scrutinize this information to understand better any potential government action.

In conclusion, while U.S. monetary authorities stepping in on a Japanese issue is uncommon, it has occurred before. Market participants will watch closely for developments in the dollar/yen currency pair.