New Ring-Buying Chart Simplifies Engagement Planning

As the global gold market experiences unprecedented fluctuations, Australian jewellers are adapting their strategies to navigate the changing landscape. Timothy Sung, director of Janai Jewellery in Melbourne, acknowledges the need for vigilance in monitoring gold prices due to rising geopolitical tensions and economic uncertainties.

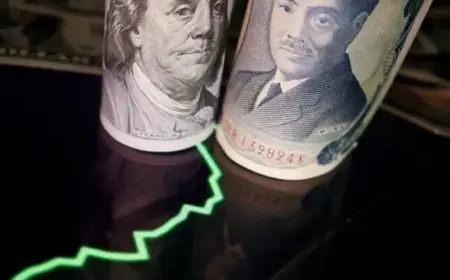

Rising Gold Prices Impact Engagement Planning

Gold saw a dramatic increase of 64% last year, marking its largest annual gain since 1979. On January 24, 2026, the price of gold soared to a record high, surpassing $4,800 per ounce. These changes have caused significant pressure on jewellers’ profit margins, with many forced to recalibrate their pricing strategies.

Consumer Demand for Jewelry Remains Steadfast

- Janai Jewellery sells approximately 300 engagement rings monthly.

- Demand for pieces with lower gold content is rising.

- Jewellers report an increase in preference for 9-carat and 14-carat gold over 18-carat.

While the demand for engagement rings remains resilient, Sung notes that consumers are shifting towards jewelry with less gold or alternative metals, such as platinum. Rising costs have prompted changes in buying behavior, as customers become more creative with their choices.

Jewellers Face New Pricing Challenges

Talitha Cummins, founder of The Cut Jewellery, highlights the challenges jewellers face in pricing their products. The steep rise in gold prices has led to a significant increase in the cost of heavier jewelry, crunched by hundreds of dollars in the interval between quotes and delivery.

- Many customers are now opting for simpler pendant designs.

- Consumers are becoming more resourceful, choosing individual pieces that require less gold.

Despite the economic pressures, jewellers like Cummins remain optimistic about their craft. However, she warns that higher prices may deter potential buyers from purchasing gold jewelry as they did in the past. The market will have to adapt to these changes to sustain engagement planning.

Future Outlook for Gold Prices

Economic analysts predict that the volatility in gold prices may continue well into the next year. Shane Oliver, chief economist at AMP, believes that high debt levels and ongoing geopolitical conflicts will keep investors focused on gold as a safe haven asset.

Ultimately, jewellers will have to stay informed and adjust their business practices to meet evolving consumer preferences and market conditions. The gold market remains unpredictable, but the demand for engagement rings persists.