Kyle Tucker to the Dodgers Raises the Stakes: A Contract Built for 2026, a Payroll Built for Scrutiny, and a Lockout Clock Ticking

Kyle Tucker joining the Los Angeles Dodgers isn’t just a headline signing—it’s a payroll and labor-relations flashpoint wrapped into one deal. The contract is designed to let the Dodgers keep stacking elite talent without feeling the full cash hit right away, but it also pulls the conversation back to the same pressure points that keep resurfacing across the sport: widening competitive gaps, escalating luxury-tax penalties, and a collective bargaining deadline that sits uncomfortably close to the next offseason.

Risk and Uncertainty: Why This Deal Fuels Big-Picture Tension

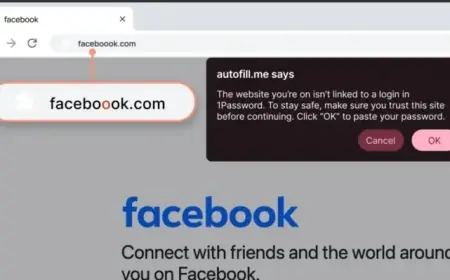

The Tucker contract highlights a growing reality in modern MLB: teams can shape “cash paid” and “tax payroll” in very different ways. For fans, the benefit is obvious—Los Angeles can run out a lineup that feels unfair on paper. For the league, it’s another example that will be used in every argument about competitive balance between now and the end of the current labor agreement.

The lockout question isn’t that Tucker “causes” anything by himself. The risk is that deals like this become symbols. Owners who want stricter cost controls can point to mega-spending clubs. Players can point to rising revenues and the fact that elite stars still command historic guarantees—while many others fight for a smaller slice. That tension matters because the current collective bargaining agreement is scheduled to expire on December 1, 2026, which is exactly when the next winter’s roster-building would normally begin.

The Kyle Tucker Contract, the Dodgers Payroll, and the On-Field Fit

Kyle Tucker contract (Dodgers):

-

Length/value: 4 years, $240 million

-

Signing bonus: $64 million

-

2026 salary: $1 million (with the larger money flowing through the bonus and later salaries)

-

Key options: player options for 2028 and 2029

-

Opt-outs: opportunities to opt out after 2027 and after 2028

-

Deferrals: $30 million deferred (spread across later payouts)

-

Tax value impact: deferrals lower the contract’s tax-value average to roughly $57 million per year rather than a flat $60 million

Kyle Tucker position: Tucker is primarily a right fielder, and that’s the cleanest fit in Los Angeles. He has experience across the outfield, but the Dodgers are signing him to be an everyday presence in right with a middle-of-the-order role.

Dodgers payroll 2026, in practical terms:

-

The competitive balance tax thresholds for 2026 climb in steps, with the top surcharge tier beginning above roughly $300 million.

-

After adding Tucker, many projections place the Dodgers’ 2026 tax payroll in the low-$400 million range.

-

That implies a nine-figure luxury-tax bill, potentially around the $150–$170 million range depending on final roster choices, injury replacements, and any in-season additions.

There’s also a roster-cost tradeoff embedded here. Tucker makes the lineup deeper, but it also tightens flexibility: every extra veteran contract, every trade acquisition, every July bullpen add-on pushes the tax bill higher in a hurry. That doesn’t stop the Dodgers—it just makes each marginal move more expensive.

MLB Lockout Context: What the Deadline Changes and What It Doesn’t

A potential MLB lockout would not be about one contract. It would be about unresolved structural issues that tend to surface late in labor cycles, such as:

-

Competitive balance mechanisms (including luxury-tax design and penalties)

-

Revenue distribution debates and local media economics

-

Calls for cost controls versus player resistance to any system resembling a cap

-

Rules tied to roster construction, player movement, and service-time incentives

The important timeline detail: with the agreement expiring December 1, 2026, the 2026 season can proceed normally even while the next offseason becomes the pressure point. If negotiations go poorly, the sport’s next major disruption risk concentrates in the winter that follows the 2026 season.

What This Means Next

Short-term changes

-

The Dodgers can pencil Tucker into right field and build a top-heavy lineup that forces opposing pitchers into constant mistakes.

-

Payroll decisions become sharper: depth pieces and deadline upgrades now carry “tax pain” beyond just the player’s salary.

-

The contract’s structure (bonus + deferrals) becomes a template other stars and teams may try to replicate.

Who benefits (neutral)

-

Dodgers fans benefit from a more stacked roster and fewer “soft spots” in the lineup.

-

Top-tier free agents benefit if deals keep pushing contract ceilings upward.

-

Teams willing to spend benefit from flexibility tools like deferrals and bonus-heavy structures.

Who loses (neutral)

-

Mid-tier clubs can lose leverage when elite talent is consistently priced out of their range.

-

Fringe roster players can see opportunity squeezed when contenders concentrate dollars into a few stars and fill the rest with minimum-salary depth.

What to watch next

-

Any follow-on Dodgers moves that convert position overlap into pitching or defense, especially in the outfield mix.

-

Whether other contenders respond with their own payroll-stretching structures rather than “standard” deals.

-

How labor rhetoric shifts as spring 2026 talks ramp up, with the December 1, 2026 deadline looming over every big-money decision.