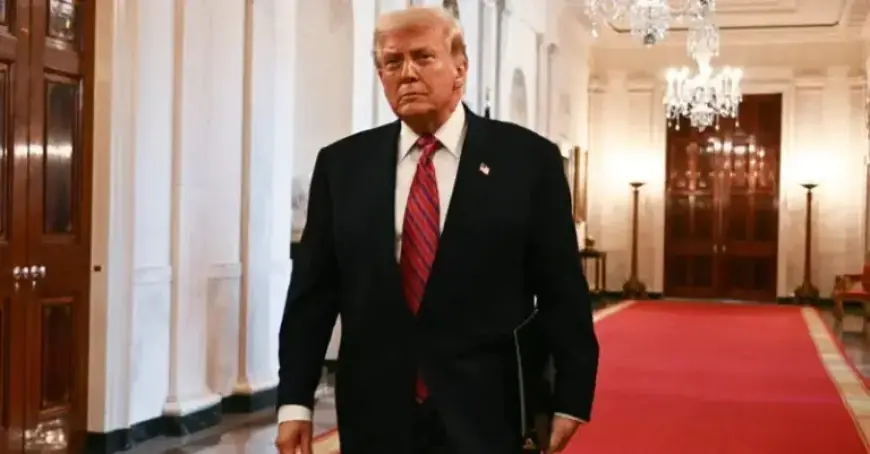

Trump Plans to Unleash Inflation Impacting His Voters

The U.S. economy is facing a pivotal moment as former President Donald Trump introduces policies aimed at releasing inflation, which could significantly impact his voter base. With the Federal Reserve at the center of this debate, Trump appears to be challenging the institution that sets vital economic policies.

Trump’s Influence on Federal Reserve Policies

Recent developments have raised concerns about the independence of the Federal Reserve. The institution employs nearly 25,000 individuals, including several hundred PhD economists responsible for determining the Fed funds rate. This rate is crucial as it dictates the borrowing costs across the U.S. economy and influences global financial markets.

On January 11, the Federal Reserve reported receiving subpoenas from the Department of Justice, suggesting a potential indictment of Chair Jerome Powell. The investigation, initially centered on overspending for building renovations, is perceived by Powell as a “pretext” for a larger agenda: to align interest rate decisions with Trump’s preferences rather than maintaining the Fed’s historical mandate for inflation control.

Potential Political Ramifications

Trump’s term as president may have come to a close, yet he continues to assert influence over economic policy discussions. His relentless critique of Powell suggests an intention to reshape monetary policy for political gain ahead of the upcoming mid-term elections in November.

- Trump seeks to replace Powell, stating interest in possible legal action against him.

- Lower interest rates are politically attractive, encouraging business activity.

- Inflation may rise if monetary policies favor cheap debt.

Economic Populism and Its Consequences

Trump has promised several populist economic measures, including providing stimulus checks and capping credit card interest rates. While these actions aim to create an illusion of financial prosperity for voters, they come with significant risks. History shows that aggressive economic populism can lead to long-term inflation.

Economists warn that stimulating consumer demand by making debt cheaper and distributing funds may ultimately burden the very voters Trump seeks to appeal to. Inflationary pressures could persist if monetary policy becomes captive to political motivations.

The Impact of Inflation on Low-Income Voters

For low-income households, inflation presents serious challenges. The wealth gap exacerbates their plight, as their disposable income is heavily impacted by rising costs. This demographic, which previously leaned toward Trump in the 2024 election, risks being further marginalized by policies that prioritize short-term benefits over sustainable economic health.

The outcome of Trump’s policies could redefine the financial landscape. The dynamics of the U.S. dollar and its international value could shift dramatically, complicating exports and contributing to inflation-related stress on lower-income constituents.

Conclusion

As Trump maneuvers to influence the Federal Reserve, the long-term implications for U.S. voters remain uncertain. The quest for electoral success may ultimately lead to economic instability, potentially disenfranchising the very supporters he aims to uplift.