TSMC’s Optimistic Forecast Fuels AI Industry Growth Hopes

Taiwan Semiconductor Manufacturing Company (TSMC) is making significant investments to capitalize on the ongoing artificial intelligence boom. The company has projected capital expenditures of between $52 billion and $56 billion for 2026, a figure that exceeds earlier expectations.

Positive Growth Projections

This ambitious spending forecast signals TSMC’s strong belief in the endurance of AI market growth. For the current year, TSMC anticipates spending at least $52 billion, representing a 25% increase from the previous year.

Revenue and Earnings Growth

- Projected revenue growth of nearly 30% in 2026.

- Net income for the most recent quarter reached NT$505.7 billion (approximately $16 billion), surpassing analyst expectations.

- Annual revenue is expected to exceed $100 billion for the first time in 2025.

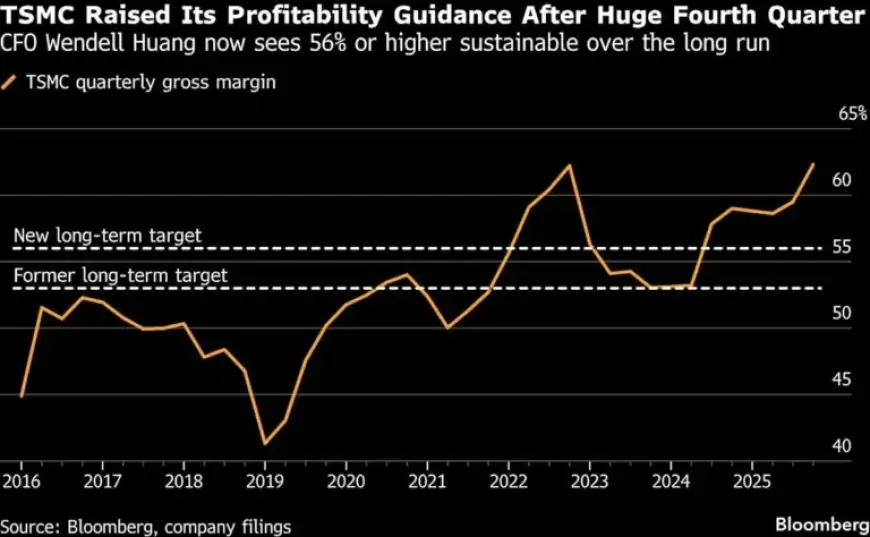

- Long-term gross margin forecasted to rise to 56%.

TSMC’s recent performance has positively impacted its American Depositary Receipts (ADRs), which jumped by 5.6% in U.S. trading. Supplier ASML Holding NV also benefited, with shares rising by 8%, pushing its market valuation past $500 billion.

AI Demand and Industry Impact

The outlook from TSMC reflects a surge in demand for artificial intelligence technologies, driven by major players like Meta Platforms and Amazon. Analysts suggest this growth may alleviate concerns regarding the sustainability of data center expenditures.

TSMC, primarily known as Nvidia’s main chip manufacturer, is expediting its global capacity expansion, particularly in the U.S., to meet escalating demand for AI applications. CEO C. C. Wei expressed caution about the authenticity of AI demand but emphasized the necessity of strategic investment.

Challenges and Opportunities Ahead

The ongoing AI chip frenzy has fueled TSMC’s growth, with planned expenditures for data centers exceeding $1 trillion. However, supply issues in the memory chip sector could impact parts of the business, leading to potential price hikes for consumer electronics.

- Annual smartphone sales are projected to decline by 11.6% in 2026.

Despite these challenges, Wei reassured investors that TSMC is well-positioned to avoid significant repercussions from memory chip shortages due to strong sales of high-end smartphones.

International Expansion Plans

In line with imminent trade agreements between the U.S. and Taiwan, TSMC is planning to enhance its investment in U.S. chip fabrication facilities, potentially committing up to $165 billion. Additionally, the company is expanding operations in Japan and Germany, which supports its global growth strategy.

Overall, TSMC’s robust spending plans and optimistic revenue projections firmly position it as a frontrunner in the rapidly evolving AI landscape. The company aims to remain a pivotal player, closing the gap between supply and demand in the semiconductor industry.