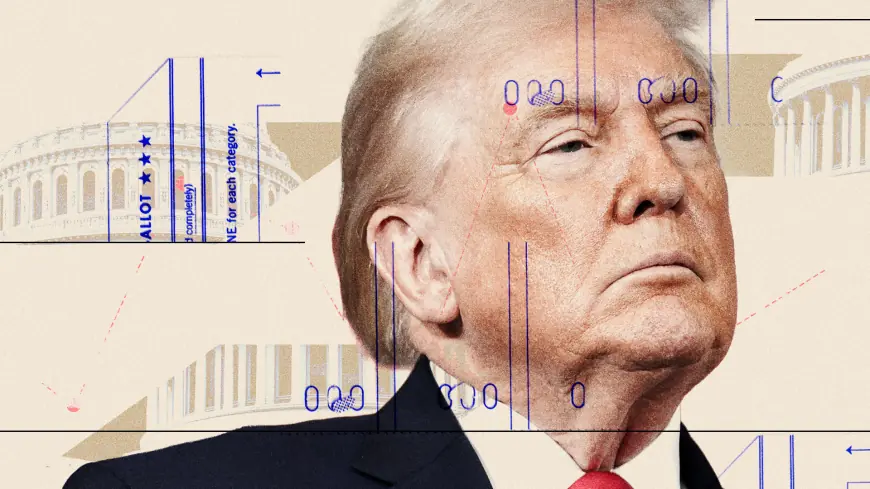

cnn data signals cracks in Trump’s ‘ruthless’ midterms strategy

New polling dynamics and a string of Democratic special-election wins have lawmakers and White House advisers reassessing whether the coalition that powered the 2024 victory can be reassembled for the 2026 midterms. A dip in approval ratings, economic unease and fraying enthusiasm among key voter groups have created a political problem that the president is trying to solve with an aggressive nationwide push.

Polling weakness and a brittle coalition

At the center of concern is the president’s approval rating, which has fallen to its lowest point in almost a year in aggregated measures. A noted data analyst warned on Monday, Feb. 16, 2026 ET that the president’s brand may not have a clear floor, noting steep underwater numbers in several tracking surveys. That erosion matters because the same coalition of voters that produced an upset in the presidential race — driven by an economic message, hard-line immigration stances, allied media figures and an influx of low-propensity voters — is showing signs of strain.

Public confidence in the economy remains fragile. Inflation, housing costs and rising premiums for healthcare plans continue to gnaw at voters’ perceptions of the administration’s stewardship. At the same time, poll swings on immigration enforcement and enforcement agencies have pushed unfavorable views higher among broad swaths of the electorate, particularly among groups that helped flip key states in 2024.

Those local dynamics are reflected in recent special elections: Democrats have captured multiple seats in districts the president carried a short time ago, flipping nine seats in contests that had once seemed secure. The pattern has rattled party officials who previously expected the president’s coattails to be sufficient to protect congressional majorities.

White House counterpunch: campaign-style mobilization

In response, the president has mounted a campaign-style blitz across the country. He has been crisscrossing battleground states with the vice president and dispatching senior officials to push an economic message designed to shore up wavering voters. The White House has ratcheted up public warnings about what would follow if the opposing party retakes Congress, framing the midterms as a referendum with high stakes for the president personally.

Inside the administration, a tight circle of advisers and allied lawmakers have been tapped to vet strategy and press the message. Senior staffers and veteran operatives have met privately to calibrate outreach that aims to replicate the high-turnout environment of 2024, with an emphasis on enticing low-propensity voters back to the polls. One senior aide has urged a full-throttle approach: put the president squarely on the ballot and run the midterms like a second presidential campaign.

Yet that approach comes with risks. Some of the demographic groups that surged toward the president in the last cycle are now more skeptical of his administration, either because of policy choices or broader political fatigue. Election analysts warn that voters who are disenchanted may be more motivated to cast ballots against the president’s party than to defend it, erasing the turnout advantage that helped produce the 2024 result.

What this means for the 2026 map

The coming months will test whether a concentrated, high-intensity push can reverse the downward trends in approval and enthusiasm. If polling momentum continues against the president and economic indicators fail to recover, Republicans may face steeper challenges in defending narrow margins in the House and Senate. Conversely, if the White House succeeds in retargeting persuadable and low-propensity voters, it could blunt potential gains for the opposition.

Lawmakers on Capitol Hill are watching the calculus closely. A handful of vulnerable incumbents have sought direct input from the president’s inner circle as they weigh messaging and fundraising strategies. The interplay between national persuasion and local campaigning will likely determine whether the current cracks deepen into structural losses or are patched in time for the midterm fight.

For now, the political terrain is unsettled. The administration’s push to mobilize the electorate is underway, but analysts caution that past presidential success does not automatically translate into midterm resilience. The next phase of campaigning, beginning in earnest this year, will show whether the president’s coalition can be reassembled or whether the fractures exposed by recent data will reshape the map heading into November 2026.