irs tax refund: What a federal shutdown could mean for your refund and how to avoid delays

As taxpayers prepare for the upcoming filing season, concerns are rising about how a partial federal government shutdown could affect irs tax refund timing. Automated processing continues, but returns that need human review may take longer — and certain refundable credits are most at risk. Financial planners urge taxpayers to file electronically with direct deposit and to use the agency’s online tracking tool before dialing the help line.

How a shutdown changes processing — but not all refunds

Automated systems that accept and process electronically filed returns remain operational during a partial shutdown. For many filers who submit clean returns and choose direct deposit, the typical window for refunds remains roughly three weeks after the return is accepted. That standard processing time reflects the agency’s automated checks and routine clearing procedures.

However, the federal workforce can be reduced during a shutdown. When staffing is limited, returns that must be pulled for manual review can sit longer than usual. Manual reviews are commonly triggered by discrepancies, identity-verification flags, or claims for certain refundable credits that by law require extra verification steps that cannot be completed entirely by automation.

Which refunds are most vulnerable and what to monitor

Refunds that include refundable credits have a higher chance of being delayed because those provisions mandate additional verification. Examples include credits that carry identity or income checks that must be validated by a human reviewer. When staffing is reduced, the backlog for those manual checks can lengthen.

Taxpayers should monitor the status of their irs tax refund through the agency’s online tracking tool. The tool updates once daily and typically reflects status changes within 24 hours of e-file acceptance. Financial planners recommend checking that tool first if a refund does not appear after the usual 21-day window.

If there is no movement displayed after four to five weeks from acceptance, it may be time to contact the agency directly. Before calling, gather your filing confirmation, Social Security numbers, and the exact refund amount shown on your return to speed any inquiry. State tax agencies are not impacted by a federal shutdown in the same way; residents should check their state portal for state refunds.

Practical steps to avoid or reduce delays

Here are clear steps taxpayers can take now to minimize the chance of a delayed irs tax refund:

- File electronically and choose direct deposit: Returns submitted this way are processed faster and reduce the chance of mail-related issues.

- Double-check entries: Simple typos in Social Security numbers, bank routing numbers, or income figures can trigger manual reviews.

- Keep documentation ready: If you claim refundable credits or have unusual income items, retain supporting documents in case verification is required.

- Use the tracking tool daily: The tool will be the first place to reflect any change in status. Give it 21 days before taking further steps for routine returns.

- Be patient but proactive: If your return shows no movement after four to five weeks, initiate contact. Having your filing details at hand will shorten any needed assistance call.

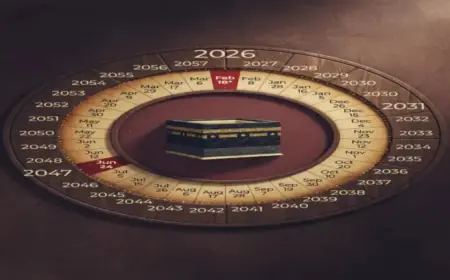

Meanwhile, political developments and recent tax law changes have led to public claims that some taxpayers could see substantially larger refunds this filing season. The administration has promoted a recent tax package that it says will deliver relief for certain groups by removing taxation on specific items and extending tax breaks that affect 2025 returns filed in 2026. Taxpayers should treat those projections as policy claims and confirm actual filing impacts when preparing returns or consulting a tax professional.

For most filers, simple precautions — e-filing, direct deposit, careful entry of information, and monitoring the online status tool — will keep refunds moving even amid short-term staffing constraints. If a delay does occur, documented patience and prompt follow-up after the recommended waiting period will usually resolve the issue.