Administration Halts Billionaire’s Coal Mine Fire Sale at Last Minute

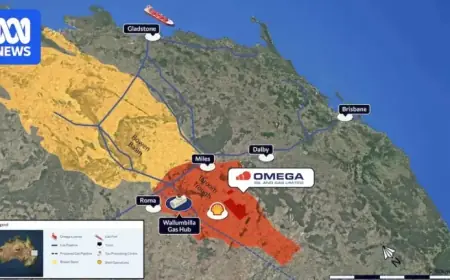

A significant development has unfolded regarding the Tahmoor Coal mine, as it has entered voluntary administration at a crucial moment. This move, announced just hours before a court hearing, is aimed at preventing liquidation due to outstanding insurance premiums.

Background of Tahmoor Coal Mine

The Tahmoor Coal mine, located south-west of Sydney, has faced turmoil since its closure in February 2023. Approximately 500 workers have been without jobs as financial issues plagued its owner, Sanjeev Gupta’s GFG Alliance.

Administration and Sale Process

Liberty Primary Metals Australia (LPMA), the mine’s parent company, was placed in administration in November 2023. An expressions-of-interest period for prospective buyers is scheduled to conclude on February 11, 2024. Recently, a local consortium led by contractor RStar put forward a $350 million offer to purchase the mine in hopes of reviving operations swiftly.

GFG Alliance confirmed the voluntary administration of Tahmoor Coal, prompting a crucial hearing by the New South Wales Supreme Court to address a winding-up application from Coal Mines Insurance (CMI). This application arose from an unpaid insurance premium dispute amounting to $4.7 million.

Role of Administrator

Joseph Hayes from Wexted has been appointed as the administrator for Tahmoor. In his court statement, Hayes expressed his intention to review the sale process over the next two weeks. He will assess the work done by LPMA’s administrators to potentially streamline the ongoing sale efforts.

Justice Ashley Black granted a one-week adjournment, allowing Hayes to conduct his investigations and underlining that further winding-up actions remain an option.

Concerns of Stakeholders

- Mining and Energy Union: President Bob Timb expressed disappointment over the company’s situation.

- Administrator’s Discussion: Timb stated intentions to advocate for a swift sale to re-employ laid-off workers.

Financial Stability Questions

The court hearing revealed troubling financial statements. Claims from unpaid creditors exceeded $18.9 million, raising “material uncertainty” regarding the company’s viability. Justice Black emphasized that adjournment requests reflect a lack of actionable plans, particularly referencing unpaid insurance dues with CMI.

Overall, the road ahead for the Tahmoor Coal mine remains fraught with challenges but holds potential for resolution with active administration and transaction efforts.