Gold price today: spot near $4,965 as futures hover around $4,980

Gold prices were steady to slightly higher on Sunday, Feb. 8, with spot trading around the mid-$4,900s per ounce as investors weighed safe-haven demand against shifting expectations for interest rates. As of 1:30 p.m. ET, spot gold was about $4,965 per troy ounce, while front-month U.S. gold futures were around $4,980.

Because major U.S. futures trading is lighter on Sunday and some markets are effectively closed, prices can look “stuck” at a level for stretches. Still, the latest quotes provide a solid snapshot of where gold is sitting heading into the new week.

Spot vs. futures: what you’re actually seeing

When people say “gold price today,” they often mean one of two benchmarks:

-

Spot gold: the reference price for immediate settlement in the wholesale market, commonly quoted as XAU per U.S. dollar.

-

Gold futures: a standardized contract price for delivery at a future date, most commonly traded on U.S. exchanges.

Futures can trade at a small premium or discount to spot depending on interest rates, storage/insurance costs, and near-term demand for hedging. On weekends, the gap can look odd because activity is thinner and some feeds update less frequently.

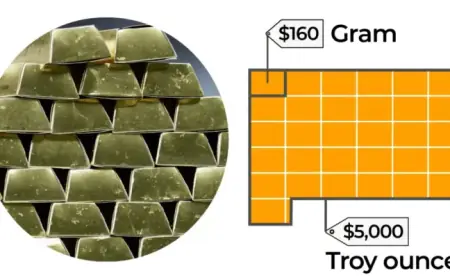

Gold price today in common units

Here are the key levels using the spot reference near $4,965 per ounce (rounded). Conversions are approximate and will vary slightly with live ticks and dealer spreads.

| Unit | Price (USD) |

|---|---|

| Spot gold (1 troy oz) | $4,965 |

| Spot gold (1 gram) | $159.6 (approx.) |

| Spot gold (1 kilogram) | $159,600 (approx.) |

| Gold futures (front month, 1 oz) | $4,980 (approx.) |

If you’re buying physical gold (coins, small bars), your checkout price can be meaningfully higher than spot due to premiums, fabrication costs, and retailer inventory risk—especially when prices are volatile.

Why gold is sitting at these levels right now

The mid-$4,900s level reflects a market still balancing two forces that often pull in opposite directions:

-

Safe-haven demand: geopolitical uncertainty, equity volatility, and recession worries can push more buyers toward gold.

-

Rate expectations: higher yields tend to pressure gold because the metal doesn’t pay interest; softer yield expectations can support it.

Gold has also been influenced by currency moves. A stronger U.S. dollar can make gold more expensive for non-dollar buyers, while a softer dollar can provide support.

Streamlined tips for viewers and buyers tracking the “real” price

If you’re watching gold closely (or planning a purchase), three practical points help cut through confusion:

-

Check the timestamp

If a quote doesn’t show a time, it may not be live. On Sundays, many feeds update less frequently. -

Know your product premium

Coins and small bars can carry higher premiums than large bars. In fast markets, those premiums can widen quickly. -

Watch the spread

Spot quotes are typically shown as a midpoint; the tradable bid/ask can be wider during thin liquidity periods.

What to watch when markets fully reopen

The next clear signal usually arrives when normal liquidity returns and futures volumes pick up. In the coming sessions, gold traders will be watching:

-

U.S. Treasury yields (a key driver for non-yielding assets like gold)

-

The U.S. dollar index (directional pressure on commodities priced in USD)

-

Risk sentiment (equities, credit spreads, and volatility gauges)

If yields fall and risk appetite weakens, gold often finds support. If yields rise sharply and the dollar strengthens, gold can face headwinds even if the broader narrative feels “risk-off.”

Sources consulted: CME Group; LBMA; Investing.com; BullionVault