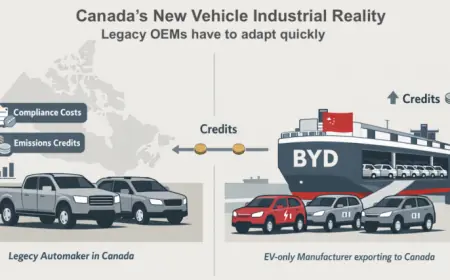

Top Chinese EV Automakers Set Sights on Canadian Market Expansion

Chinese electric vehicle (EV) manufacturers are eyeing Canada as a strategic entry point to expand their presence in North America. This market offers stringent safety regulations and a growing consumer base inclined toward electrification. Industry experts anticipate that while 49,000 units from Chinese automakers are set to enter the Canadian market, this number represents a mere 3.77% of the overall market shares dominated by established brands like Ford, Honda, and Toyota.

China’s EV Market Entry Strategy

In recent years, BYD, a leading Chinese EV manufacturer, has set the benchmark globally. In 2024, the company sold 4.27 million new energy vehicles, securing an impressive 18% of the global market. With its robust vertical integration in battery production and vehicle manufacturing, BYD is poised to command approximately 40% of the Canadian quota, equating to about 19,600 vehicles.

Other Key Players and Their Market Positions

- Chery: Expected to secure about 10% of the Canadian quota, approximately 4,900 vehicles. Chery has a proven track record in complex markets, making it a strong contender despite lacking the allure of newer brands.

- Dongfeng: Anticipated to take around 3% of the quota (about 1,470 vehicles) due to its extensive experience in international quality standards and potential for fleet sales.

- Geely: Likely to capture 15% of the quota (around 7,350 vehicles), leveraging its established foothold through partnerships with renowned brands like Volvo.

- Jiangling Motors: Projected at 3% of the quota (approximately 1,470 vehicles), focusing primarily on commercial vehicles, which may see swift adoption in Canada.

- NIO: Expected to be capped at around 4% of the quota (around 1,960 vehicles) due to its complex infrastructure and capital-intensive model.

- SAIC Motor: Predicted to command about 20% of the quota (approximately 9,800 vehicles), drawing from its rich history of joint ventures that bolster its operational trustworthiness.

- XPENG: Anticipated to secure around 5% of the quota (about 2,450 vehicles), focusing on advanced technology yet facing challenges in scaling across Canada’s vast geography.

Conclusion: The Future of Chinese EVs in Canada

The future landscape of Chinese EVs in Canada will be shaped not just by innovation but also by institutional maturity. Automakers like BYD and Geely are leveraging their operational insights to navigate the complexities of the North American market effectively. In contrast, others must demonstrate their ability to adapt and build brand credibility. Canada could serve as a crucial proving ground for these brands, providing insights into their potential success across the broader North American market.