Drivers Face New 80p Per Litre Charges

Recent changes in regulations are reshaping gas prices for drivers in the UK. A new law has been implemented to enhance price transparency at petrol stations. This initiative aims to ultimately help reduce costs at the pump, though another regulatory change is expected to increase prices later this year.

New Reporting Requirements for Petrol Stations

Effective Monday, all petrol stations must now report their prices to a centralized Fuel Finder map. This tool allows drivers to locate the most affordable options in their area. Initiated by the Competition and Markets Authority, this move intends to foster competition among filling stations.

Expected Savings for Drivers

As a result of these changes, drivers are projected to save an average of £40 annually on fuel costs. This new legislation aims to enhance market competitiveness and may translate into lower petrol and diesel prices at the pumps.

Upcoming Fuel Duty Changes

While drivers may benefit from immediate savings, they should prepare for an increase in costs later this year. In September, the temporary fuel duty freeze—which has been in effect since 2011—will come to an end. Currently, fuel duty stands at 57.95p per litre, but an additional 5p hike in taxes is anticipated.

- Current effective fuel duty: 52.95p per litre (after a 5p cut).

- Projected fuel duty after September 2023: 58p per litre.

- Percentage of fuel tax paid: Over 60% of the retail price at the pump.

This increase will occur through a gradual approach, with prices rising until March 2027. Currently, the total retail price at the pump includes 57.95p in fuel duty and an additional 20% VAT, significantly impacting overall costs for consumers.

Fuel Cost Implications

| Price Breakdown | Amount (per litre) |

|---|---|

| Current Average Petrol Price | 131.9p |

| Projected Fuel Duty (post-freeze) | 58p |

| Projected VAT | 22p |

| Total Tax Charges | 80p |

| Amount Going to Retailer | 51.97p |

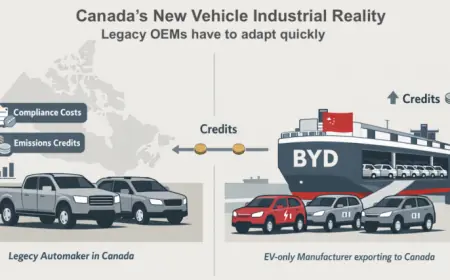

Future Taxes for Electric Vehicles

Starting April 2028, a new mileage tax will apply to electric vehicles (EVs). This is intended to recover revenue lost due to a lack of fuel duty. Rates will be set at

- 3p per mile for battery electric cars

- £0.015 per mile for plug-in hybrid cars

This new tax is anticipated to add approximately £300 for every 10,000 miles driven in an electric vehicle. The Chancellor has stated that these funds will be allocated towards road maintenance. However, the specific implementation details remain unclear at this stage.

As these changes unfold, drivers must remain vigilant about the evolving landscape of fuel pricing and taxation in the UK.