Canada Shifts EV Policy Focus from Mandates to Credits

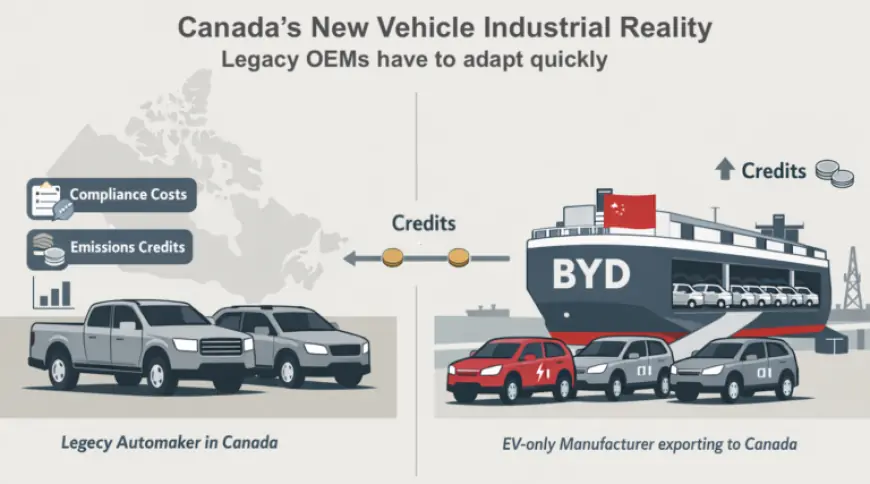

Canada is undergoing a significant transformation in its electric vehicle (EV) policy, moving away from mandatory sales quotas to a credit-based system. The new approach focuses on tightening fleet average emissions standards rather than imposing strict targets on the proportion of EVs sold.

New EV Policy Framework in Canada

The Canadian government has strategically opted for an emissions trading framework. This involves gradually tightening greenhouse gas emissions standards for automotive fleets. Instead of enforcing a specific percentage of electric vehicles in sales, manufacturers now face a blended emissions target based on the total vehicles sold each model year.

Understanding the Emissions Standards

As of late 2020s, the emissions standards will progressively become stricter. EVs will effectively count as zero emissions, whereas internal combustion vehicles will be assessed according to their certified CO2 emissions. This creates a scenario where compliance is based on average emissions rather than the percentage of electric vehicles sold.

- Emission Targets: Fleet averages are set to reduce significantly over the years:

- 170 gCO2/km in 2027

- 153 gCO2/km in 2028

- 138 gCO2/km in 2029

- Close to 100 gCO2/km by 2032

Credits and Their Role in Compliance

Compliance within this system will utilize credits calculated based on lifetime vehicle emissions. This approach requires a significant shift for automakers. For instance, a zero-emission vehicle adds credits that can be utilized to offset emissions from higher-emission vehicles within the same fleet.

General Motors (GM) serves as a noteworthy example. With a sales mix that included approximately 8% EVs, GM faced compliance deficits. To meet tightened standards, GM would need to increase its EV sales dramatically. From 25,000 EVs, the target would shift to over 100,000 by the early 2030s under current projections.

Trade Policy Implications

Trade policies further bolster this emissions strategy. Canada has agreed to allow a set number of Chinese-manufactured EVs to enter the market without the previously proposed 100% import surtax. This facilitates a more diverse electric vehicle market while helping manufacturers achieve compliance with the new emissions targets.

Financial Dynamics of Credits

The credit system can yield substantial financial benefits. For example, a vehicle sold into the Canadian market may generate credits valued between $5,000 to $7,400 depending on market dynamics. With trade allowances, firms can access a lucrative revenue stream while promoting lower emissions.

Long-term Strategy and Flexibility

This new policy framework encourages legacy automakers to adapt faster to electrification. They retain options for managing emissions through compliance credits, rather than facing strict sales mandates. The flexibility offered by this approach is seen as less restrictive and aligns more closely with market demands.

- Benefits of the New Framework:

- Reduction in regulatory pressure through a market-driven approach

- Permits timing and flexibility in transitioning to electric vehicles

- Establishes a long-term, sustainable emissions strategy

Challenges Ahead

While the immediate changes seem favorable, there are future challenges. As emissions standards tighten annually, automakers may face rising compliance costs, especially if EV adoption rates do not accelerate. The structure could unintentionally lead to higher costs of compliance as credits become scarcer.

Canada’s shift in policy creates an environment where manufacturers must prioritize EVs while maintaining competitive pricing. This strategic move reflects a comprehensive industrial plan that balances environmental goals with economic viability.

As automakers adapt to the new framework, there’s an expectation that fleet compositions will shift significantly over the coming years, propelling Canada towards a more sustainable automotive future.