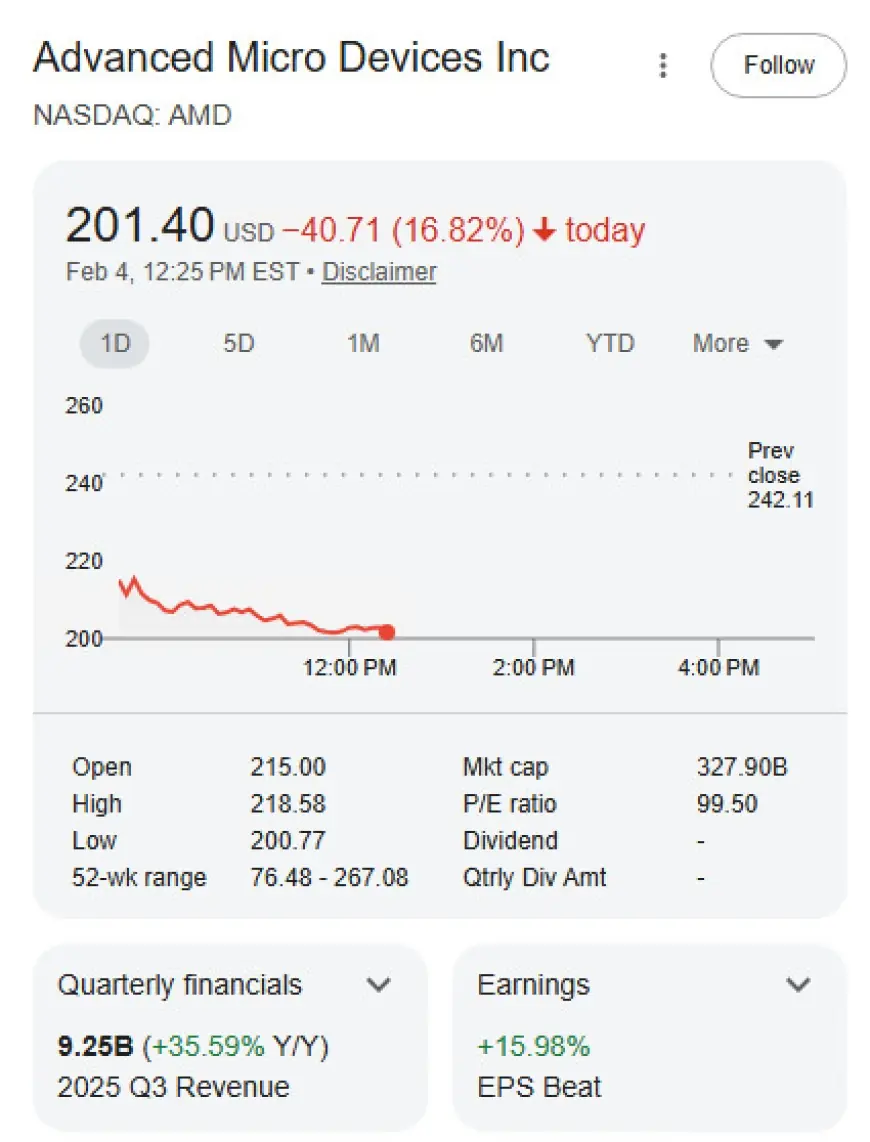

AMD Stock Drops After Earnings Even as Revenue Jumps, Putting the Next Earnings Call Questions on AI Chips, China, and 2026 Guidance

AMD stock is moving sharply today as investors digest a strong quarterly report that still failed to calm one core debate: how fast AMD’s AI accelerator business can scale in 2026 without running into export limits, supply constraints, or tougher competition.

As of Wednesday, February 4, 2026, late morning ET, AMD shares were trading around $201.81, down significantly from the prior close after a volatile open and wide intraday range.

AMD stock price today: why the move looks bigger than the earnings beat

AMD delivered a clear top-and-bottom-line beat in its latest results, including quarterly revenue of about $10.27 billion and adjusted earnings per share around $1.53. On paper, that’s the kind of report that typically supports a rally.

Instead, the stock reaction tells you what the market is actually pricing: not whether AMD had a strong quarter, but whether the next few quarters will show a clean, accelerating AI ramp that can justify the premium investors have been paying for “AI winners.”

The immediate pressure point is guidance. AMD’s Q1 2026 revenue outlook of roughly $9.8 billion plus or minus $300 million came in above many expectations, yet the market appears to be treating that as “good, but not decisive” for the longer-term AI narrative.

What happened on the AMD earnings call: the three themes investors cared about most

AMD held its earnings call on Tuesday, February 3, 2026 at 5:00 p.m. ET, and the discussion quickly concentrated around three issues:

1) Data center momentum vs. AI accelerator expectations

AMD’s data center business remains the headline growth engine, boosted by continued demand for server CPUs and rising shipments of its accelerator products. The key investor question is whether accelerators are becoming a predictable, repeatable revenue stream rather than a lumpy series of customer deployments.

Translation: investors want clarity on how much of AMD’s AI revenue is already locked in with real schedules versus still dependent on pilots, qualification cycles, and capacity.

2) China exposure and export rules

Another tension point is the role of China in near-term results and how future restrictions could change the mix. Even if current-quarter sales are legal, investors dislike uncertainty around what can be shipped, what must be redesigned, and how quickly policy changes can hit revenue.

This matters because AI accelerators are precisely the kind of products that can become policy targets, which makes “guidance quality” as important as “guidance level.”

3) The product roadmap and competitive positioning

AMD’s leadership emphasized its upcoming accelerator roadmap and broader platform strategy, aiming to convince markets that it can keep narrowing the gap with the category leader while defending margins.

The market’s skepticism tends to show up in the same place every time: “prove it in quarterly numbers.” Not presentations, not partnerships, not benchmarks in isolation.

Behind the headline: why a beat can still lead to a selloff

This is the classic AI-cycle earnings setup:

-

The company posts big growth and beats estimates.

-

The stock still falls because expectations were even higher, especially for AI.

-

The debate shifts from “is AMD improving?” to “is AMD improving fast enough to justify the multiple?”

There’s also a structural reason this reaction keeps happening across the chip sector: investors have started treating “AI capex” like a macro variable. If the market thinks cloud spending is peaking, any perceived softness or ambiguity in AI-specific commentary gets punished even if the quarter was objectively strong.

What we still don’t know about AMD’s 2026 trajectory

Several missing pieces will likely dominate follow-up questions in the next earnings cycle:

-

How quickly major customers move from initial deployments to scaled rollouts

-

Whether supply chain capacity becomes a ceiling for accelerator growth

-

How much pricing power AMD can maintain as competition intensifies

-

How export controls reshape which products ship where, and at what profitability

Until those points become clearer, AMD stock can remain headline-sensitive even when fundamentals look strong.

What happens next: the scenarios traders are watching

-

Rebound on stabilization

Trigger: the stock finds support and the market reframes the quarter as “strong enough” once volatility fades. -

More downside if AI expectations reset across the sector

Trigger: other major AI-linked earnings imply slower spending growth, pushing multiples lower. -

Rotation toward “visible” revenue stories

Trigger: investors reward companies that can show booked demand, recurring shipments, and tighter guidance ranges. -

A renewed rally if AMD provides clearer AI shipment milestones

Trigger: management gives more concrete forward indicators that reduce uncertainty around accelerators and customer timing.

If you want, tell me whether you care more about short-term trading (today’s levels, support zones, catalysts) or long-term investing (earnings power, AI share, and valuation), and I’ll tailor the AMD stock breakdown accordingly.