Novo Nordisk Warns of Unprecedented Price Pressures Impacting Wegovy Sales

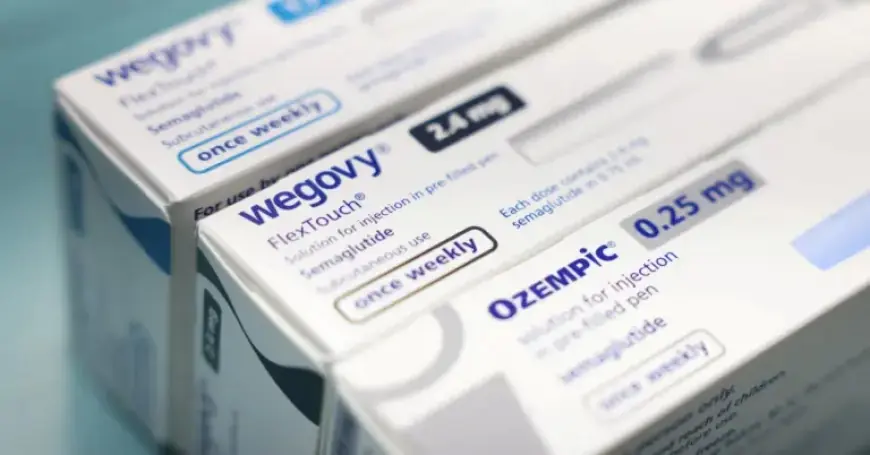

Novo Nordisk has issued a warning about significant price pressures affecting its sales of Wegovy and Ozempic, its leading weight-loss drugs. This revelation followed a sharp decline in the company’s stock price, erasing nearly $50 billion in market value. The decline was attributed to expectations of a sales and profit downturn as fierce competition intensifies in the obesity drug market.

Price Pressures and Market Competition

On February 4, 2024, Novo Nordisk reported that it anticipates profits and sales may fall by as much as 13% in the current year. This stark forecast contrasts with analysts’ expectations of a more modest 2% decline. The company attributed the downturn to increasing competition, especially from Eli Lilly, and a push from the U.S. government to lower drug prices.

Impact of the U.S. Market and Pricing Strategies

The shift in the U.S. healthcare landscape, particularly regarding self-payment models and rising rebate demands from insurers, has further complicated the situation for Novo Nordisk. Chief Financial Officer Karsten Munk Knudsen indicated that U.S. sales might drop significantly, likely in the “teens,” signaling a sharper decline than the company’s estimates. The company’s share price fell by 16% in response to these developments.

Details on Wegovy and Ozempic Pricing

- Wegovy’s lower doses are currently priced at $149 per month for self-paying patients.

- This price will increase to $199 in April 2024.

- Similarly, other obesity drugs, including those from Eli Lilly, are also seeing price adjustments.

The injection version of Wegovy has been sold at $349 monthly since its launch for cash payers in November 2023. Novo has acknowledged that pricing pressures and competition have played significant roles in their revised sales forecasts.

Emerging Competition and Market Dynamics

As the obesity drug market grows, Novo Nordisk faces challenges from an influx of new competitors and “copycat” products. Approximately 1.5 million Americans are reportedly using compounded versions of GLP-1 medications, which complicates market dynamics for branded products like Ozempic and Wegovy.

Future Prospects and Consumer Behavior

Despite the challenges, there is some optimism regarding the Wegovy pill, with weekly prescriptions reportedly reaching around 50,000 by late January 2024. Many consumers appear willing to pay out of pocket for this treatment, which may suggest a potential new revenue stream through telehealth partnerships.

Evaluation of Novo Nordisk’s Position

Market analysts and investors have expressed disappointment at Novo’s projections for 2026, characterizing it as unexpected and alarming. The company’s journey, once marked by significant growth, may face hurdles due to these evolving market conditions.

As Novo Nordisk navigates these unprecedented challenges, stakeholders will be closely monitoring developments in the pricing and competitive landscape of obesity drugs. The company remains focused on adapting its strategies to ensure a future return to growth despite current pressures.