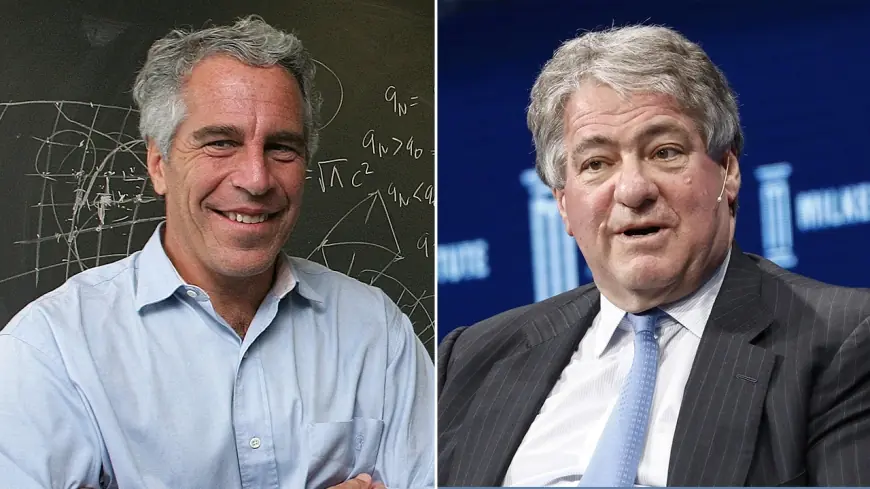

Leon Black back in spotlight as new Epstein-related records renew scrutiny

Leon Black, the billionaire co-founder of Apollo Global Management, is again drawing intense attention after a fresh wave of Jeffrey Epstein-related records and emails revived questions about how Epstein used his access to powerful people—and how some of those relationships continued after Epstein’s earlier criminal case.

The renewed focus has not produced new criminal charges against Black, and he has long denied any wrongdoing beyond what he has described as a professional relationship that he has said he deeply regrets. Still, the latest disclosures are reshaping the public conversation around his post-Apollo life: his investments, his reputation in cultural and philanthropic circles, and the lingering aftershocks of the payments he made to Epstein for financial and estate work.

The new trigger: emails, names, and renewed questions

The immediate catalyst this week was the emergence of additional email traffic involving Epstein and prominent figures, including communications connected to a major law firm whose leadership acknowledged past interactions with Epstein. Black enters the frame because those interactions were described as having originated through a client relationship with him.

Separately, newly released Epstein-related materials have circulated online and in court filings, prompting a fresh cycle of name searches and headline attention. In this environment, even documents that do not allege criminal conduct can reignite reputational damage, especially for public figures who previously faced scrutiny tied to Epstein’s network.

What remains unclear is how much of the newly discussed material is genuinely “new” versus newly compiled, newly public, or newly emphasized. But the impact has been immediate: Black’s name is once again central to the broader debate over accountability, gatekeepers, and how Epstein leveraged financial services to maintain influence.

The payment history that won’t go away

Black’s connection to Epstein became a major public issue after disclosures that Black paid Epstein large sums for tax, estate, and related financial services over several years. That relationship helped spur an internal investigation at Apollo and contributed to Black stepping away from leadership at the firm in 2021.

The controversy has proven durable because the amounts were extraordinary by ordinary professional-services standards, and because they continued after Epstein’s earlier legal troubles were widely known. Black has maintained that the work was legitimate financial and estate planning, that he was unaware of Epstein’s criminal conduct, and that he now views the relationship as a serious mistake.

The payments also became central to civil and governmental scrutiny. In 2023, Black reached a settlement with the U.S. Virgin Islands to resolve potential claims tied to the territory’s investigation of Epstein’s trafficking operation and its enablers. The settlement did not include an admission of wrongdoing, but it kept the issue in the public eye.

Legal posture: civil fallout, shifting focus

In addition to reputational damage, Black has faced civil claims and legal disputes connected to allegations that he has denied. Some cases have ended through dismissals, settlements, or procedural rulings, while other claims have drawn headlines before fading from court dockets.

The current cycle of attention is less about a single courtroom milestone and more about how a growing archive of materials—emails, witness accounts, investigative files, and civil-case exhibits—can continuously reshape narratives. That creates an unusual kind of pressure: even if no new legal action emerges, reputational risk can rise again with each disclosure batch or newly public tranche of records.

In practice, that can influence everything from business counterparties’ comfort level to board appointments and cultural affiliations, particularly in New York’s finance-and-arts ecosystem where Black has historically been a major presence.

Art, philanthropy, and “legacy” recalculations

Black’s profile has long spanned far beyond private equity: major charitable donations, medical research support, and high-value art collecting. Recent reporting tied newly surfaced Epstein-related materials to art-market dealings, raising fresh questions about the ways Epstein may have facilitated introductions or transactions.

This is the most sensitive terrain for legacy-building, because it intersects with public-facing institutions that often depend on donor trust. Even when gifts are unrelated to misconduct, institutions can face renewed pressure when a donor’s name becomes the subject of widespread controversy again.

At the same time, parts of the Black family’s philanthropic footprint have shifted in recent years, including changes in grantmaking posture and visibility. Those moves are now being reread through the lens of reputational risk management.

What happens next

Near-term, the biggest variable is whether additional Epstein-related releases include material that is both verifiable and substantively different from what was previously known. If the flow slows, the story may revert to periodic spikes tied to court filings, legislative inquiries, or investigative reporting. If new documents keep surfacing, the pressure on high-profile names—Black included—could remain elevated through the spring.

For Black personally, the next chapter is likely to be defined less by formal corporate roles and more by how he navigates public scrutiny while pursuing investments and philanthropy in an environment where counterparties and institutions are increasingly cautious.

Sources consulted: Reuters; The Guardian; ABA Journal; Forbes