PayPal stock sinks after earnings miss as Enrique Lores set to replace Alex Chriss

PayPal shares tumbled Tuesday after the company posted a quarterly earnings and revenue miss, offered a softer 2026 profit outlook than many investors expected, and announced a CEO change. The selloff pushed PYPL to its lowest levels in months and put renewed pressure on management to show that its turnaround plan can translate into faster growth in branded checkout and more durable margin expansion.

By 8:15 p.m. ET on Tuesday, Feb. 3, 2026, PayPal stock was trading around $41.70, down roughly 21% from the prior close, after a volatile session that saw the shares trade as high as the mid-$50s before sliding into the low $40s.

PayPal earnings: what missed and what held up

For the quarter, PayPal reported revenue of $8.68 billion and adjusted earnings per share of $1.23, both below the consensus expectations that had clustered around the high-$8.7 billion range for revenue and roughly the upper-$1.20s for adjusted EPS. The company’s net income rose from a year earlier, but the market reaction centered on the top-line miss and the outlook.

There were bright spots that management highlighted, including payment volume growth and continued engagement in key products. PayPal said total payment volume was about $475.1 billion, and active accounts were about 439 million, indicating the platform’s scale remains substantial even as competition intensifies across checkout, wallets, and buy-now-pay-later.

Guidance and targets: why 2026 outlook spooked investors

The sharper negative reaction came from guidance. PayPal indicated that 2026 adjusted EPS could be flat to down slightly, or only up marginally, versus the prior year—framing a year of execution-heavy rebuilding rather than quick acceleration. The company also pulled back on longer-dated targets it had previously discussed, which investors had been using as an anchor for valuation.

The market message was clear: if growth is slower and long-term targets are less certain, the burden shifts to near-term proof points—particularly improvements in branded checkout conversion, transaction profitability, and take rate stability.

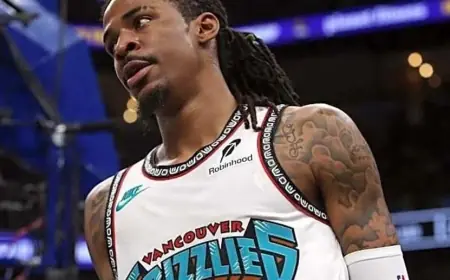

CEO change: Enrique Lores takes over, Alex Chriss exits

PayPal announced that Enrique Lores will become chief executive officer, replacing Alex Chriss. Lores is best known for leading a major global hardware company and has served on PayPal’s board; he is expected to step into the CEO role on March 1, 2026 (ET).

The leadership swap is significant because it resets expectations for strategy and pace. PayPal’s recent narrative has been a focused turnaround—simplifying the product story, improving checkout experiences, and driving more profitable volume. A new CEO inherits that plan, but investors typically look for early signals: whether priorities change, whether cost discipline tightens, and how quickly leadership clarifies what “winning” looks like in core checkout and wallet experiences.

Venmo and product levers: what could stabilize sentiment

PayPal pointed to areas of momentum that could matter in the next few quarters. One key figure: Venmo revenue grew about 20% to $1.7 billion, reinforcing Venmo’s role as both a consumer brand and a monetization engine. The company also emphasized continued work in buy-now-pay-later and improvements to checkout experiences designed to raise conversion and repeat usage.

PayPal also introduced a quarterly dividend of $0.14 per share, a shareholder-friendly move that can broaden the investor base but also signals a more mature capital-return posture at a time when growth investors want acceleration.

Key numbers and where PYPL stands now

| Metric | Latest reported / observed | Why it matters |

|---|---|---|

| Q4 revenue | $8.68B | Top-line miss drove the selloff |

| Q4 adjusted EPS | $1.23 | Below expectations; pressure on 2026 outlook |

| Total payment volume | ~$475.1B | Scale remains large; growth quality is the question |

| Active accounts | ~439M | Engagement and retention remain critical |

| Venmo revenue | $1.7B (+20%) | A core growth lever investors track |

| PYPL price | ~$41.70 at 8:15 p.m. ET (Feb. 3) | Down about 21% on the day |

What to watch next

Two near-term milestones are likely to set the tone for PYPL. First: early guidance updates and commentary from Lores after he formally takes the helm, especially around branded checkout improvements and competitive positioning. Second: the next quarterly report, where investors will be looking for signs that the earnings outlook is stabilizing—either through better revenue trends or clearer margin traction.

If PayPal can show that checkout initiatives are lifting conversion and that product-led growth can offset price pressure, the stock may find firmer footing. If not, the market is signaling it will demand a higher discount for uncertainty—especially with leadership changing midstream.

Sources consulted: Reuters; MarketWatch; Barron’s; company earnings release and investor materials