Judge Rules Sunterra’s Cheque Kiting Costs $35M to U.S. Lender

In a recent ruling, an Alberta court found Sunterra liable for engaging in cheque kiting, resulting in a $35 million loss to the U.S. lender Compeer Financial. Justice Michael Lema of the Court of King’s Bench in Calgary delivered the verdict on January 27. He likened the situation to a game of musical chairs, emphasizing the fraudulent nature of Sunterra’s practices.

Sunterra’s Cheque Kiting Scheme

The ruling revealed that Sunterra, continuing from its origins as Pig Improvement Canada, misrepresented its cheque transactions. These involved sending large sums back and forth between Canadian and U.S. operations without actual business activities.

- Founded: 1970 by the Price family in Alberta.

- Sunterra Meats Launched: 1990.

- Retail Locations: Calgary, Edmonton, Red Deer.

- Total Intercompany Transfers in 2024: Nearly $6.3 billion.

Justice Lema’s decision outlined the unsustainable practice, where incoming cheques were not backed by real cash balances. The judge concluded that Sunterra’s activities amounted to cheque kiting “on an astonishing scale.” This fraudulent practice ultimately led to Compeer freezing accounts in February 2025, ceasing the clearing of all incoming cheques.

Impact on Sunterra and Leadership Liability

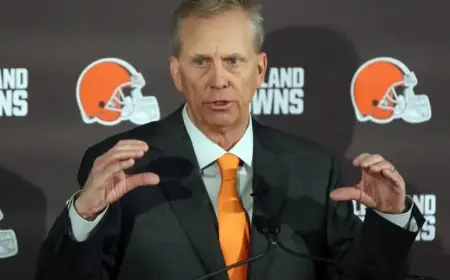

The court held Ray Price, Sunterra’s president, personally liable for the company’s actions, indicating that he directed the cheque kiting operations. However, other Sunterra employees were not held responsible as they acted under instructions. The ruling states that the significant losses incurred by Compeer were a direct result of this fraudulent behavior.

Sunterra is currently undergoing restructuring under the Companies’ Creditors Arrangement Act (CCAA), which allows companies a respite from creditors. However, since the judge deemed the debt arose fraudulently, Sunterra cannot seek relief from Compeer without permission.

- Judge’s Ruling Date: January 27.

- Potential for Appeal: Sunterra is considering an appeal against the ruling.

Companion Judgment Involving National Bank

A companion judgment was released on January 29 concerning the National Bank of Canada, which was facing potential claims by Compeer. The judge dismissed these claims, finding them too speculative to proceed. National Bank has since denied any wrongdoing and stated that Sunterra’s Canadian entities should cover any liabilities arising from this situation.

Legal experts suggest that while Sunterra’s liabilities are significant, the final amount owed to Compeer remains undetermined as they will submit updated calculations. Anna Lund, a University of Alberta professor specializing in insolvency law, noted that an appeal remains a viable option for Sunterra given ongoing developments.

The implications of this ruling echo beyond just Sunterra and its operations, serving as a cautionary tale regarding financial practices and corporate responsibility.