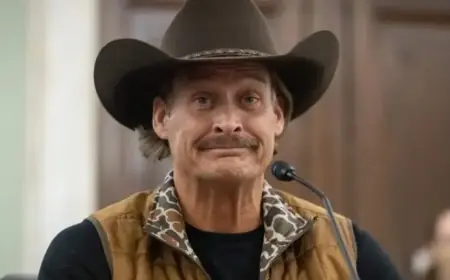

Galaxy Analyst Predicts Bitcoin May Fall Below $60K

Bitcoin’s price has entered a troubling downward trend, with predictions suggesting it could dip below $60,000. Analysis from Galaxy’s Head of Firmwide Research, Alex Thorn, highlights several factors contributing to this potential decline. As of Tuesday, Bitcoin was priced around $77,873, having already fallen approximately 38% from its October all-time high of nearly $80,000.

Market Indicators and Predictions

Thorn’s research indicates a structural weakness in Bitcoin’s pricing. Key points include:

- Predicted drop towards the 200-week moving average at $58,000.

- Failure to act as a debasement hedge while gold prices have surged.

- Lack of near-term catalysts to support Bitcoin’s price.

As Bitcoin experiences a significant decline, Thorn noted that it could gravitate towards the bottom of its supply gap at $70,000 before testing critical levels of $56,000 and $58,000.

Historical Data Insights

Historical on-chain data reinforces concerns about further losses for Bitcoin. According to Thorn, when the cryptocurrency has previously fallen by at least 40% from its high, it has typically extended losses to 50%, with only one instance bucking this trend. Additionally, data from the last three bull cycles show that drops below the 50-day moving average have led to further declines towards the 200-week moving average.

Current Market Trends

Despite the bearish outlook, some long-term investors may find opportunity in this downturn. Thorn pointed out that long-term profit-taking has started to wane. In 2024 and 2025, long-term holders sold more Bitcoin than at any other time in the cryptocurrency’s history. This trend appears to be easing, potentially indicating that the market is approaching a bottom.

Long-Term Investment Perspective

Bitcoin’s current price around $77,873 represents a significant drop. A decrease to $58,000 would mean an additional loss of about 25%. However, Thorn suggests that such levels would provide compelling entry points for long-term investors, similar to historical precedents.

Lastly, a prediction market operated by Decrypt’s parent company, Dastan, indicates a 66% chance that Bitcoin will drop to $69,000 before any recovery towards $100,000 is seen.