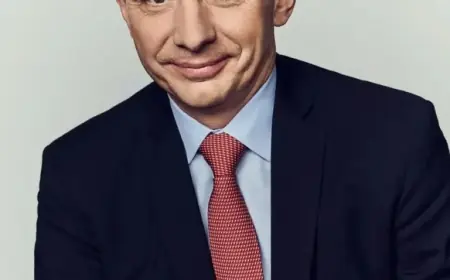

Michael Burry Warns of Dire Scenarios if Bitcoin Keeps Falling

Michael Burry has issued a stark warning regarding the future of Bitcoin. He predicts dire scenarios if the cryptocurrency fails to recover from its current decline. Burry, famously known for his role in the film “The Big Short,” shared his insights in a recent Substack post. His warnings coincide with Bitcoin’s troubling performance, having completed January with its fourth consecutive month of losses, the longest stretch since 2018.

Currently, Bitcoin is down approximately 37% from its peak last year. This trend has already begun to show adverse effects on the broader market. Burry pointed out that recent declines in gold and silver prices might be linked to Bitcoin’s downturn. He emphasizes that both assets share similarities in their market dynamics, particularly regarding their tokenized nature.

Possible Consequences of Bitcoin’s Decline

Burry outlined three significant consequences that could arise if Bitcoin continues to fall.

- Severe losses for financial institutions

Burry warned that if Bitcoin drops below $70,000, it could lead to substantial losses for various crypto-holding institutions. For example, Michael Saylor’s Strategy could face over $4 billion in losses, which would severely limit its access to capital markets. Other institutions might also incur losses between 15% and 20% on their Bitcoin holdings, prompting risk managers to take aggressive financial measures. - Existential crisis for Strategy

A drop to $60,000 could trigger an “existential crisis” for Strategy. As the world’s largest corporate Bitcoin holder, any significant Bitcoin sales from Saylor’s firm could severely impact the entire crypto market. Recently, there have been rumors that Strategy would sell portions of its Bitcoin holdings, further alarming investors. - Bankruptcies among crypto miners

If Bitcoin’s value plunges to $50,000, Burry warns of potential bankruptcies among crypto miners. This scenario could lead to a mass sell-off of Bitcoin reserves. Additionally, Burry predicts that the metal market would suffer dramatically, with tokenized metals futures collapsing, as demand for physical metals may diverge from established trends.

Market Implications

Burry’s predictions reflect the interconnected nature of financial markets. The cryptocurrency industry’s challenges are not isolated; they could induce significant repercussions in traditional markets such as precious metals. His consistent skepticism towards Bitcoin raises questions about its long-term viability.

Known for his critical stance, Burry previously likened Bitcoin to the infamous tulip bubble, drawing parallels to historical market irrationality. He maintains that Bitcoin’s current trajectory needs to reverse quickly to avoid the scenarios he has outlined.

As the crypto landscape continues to evolve, Burry’s insights present a stark reminder of the potential risks involved in digital currencies. Investors are urged to evaluate the implications of these predictions carefully.