Economist Warns of Canada’s Economic Recession Crisis

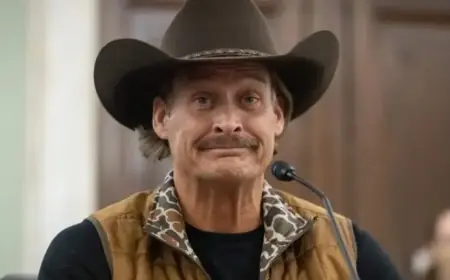

Canada’s economy is facing significant challenges, with many indicators suggesting a recession is underway. David Rosenberg, chief economist and founder of Rosenberg Research, shared insights on BNN Bloomberg regarding the state of Canada’s economy, emphasizing the need for further interest rate cuts by the Bank of Canada.

Current Economic Climate

Rosenberg pointed out that Canada’s gross domestic product (GDP) is currently growing at only one percent annually, a concerning figure considering the backdrop of earlier interest rate cuts. The Bank of Canada had previously set its rates high at five percent but has since reduced them.

Labor Market and GDP Concerns

- Annual economic growth sits at just one percent.

- Per capita GDP is in decline despite interest rate reductions.

- Inflation levels are reportedly not a pressing concern for the economy.

Furthermore, the manufacturing and housing sectors are not thriving, with home prices decreasing by two percent year-over-year. Notably, the manufacturing sector, which heavily relies on trade with the United States, has also experienced a downturn, showing a decline of five percent.

Housing Market Stagnation

Rosenberg remarked on the stagnant residential construction sector, likening expenditure levels to being “flat as a beaver tail.” Despite predictions that the Bank of Canada’s rate cuts would spur housing inflation, the opposite appears to be true. For ten consecutive months, home prices across Canada have shown little to no sequential increase.

- Home prices: down two percent year-over-year.

- Residential construction: stagnant despite rate cuts.

Trade Relations Impact

Recent fluctuations in trade relationships with the U.S. add another layer of complexity. Rosenberg noted that, despite hopes for improved trade dynamics, manufacturing remains lackluster. Even with favorable exchange rates and strong U.S. economic growth, there is little evidence of growth in Canadian manufacturing.

Currency Performance and Outlook

Rosenberg suggested a comparison of the Canadian dollar with the Australian and New Zealand dollars, which reflect stronger internal demand. Recently, the Canadian dollar has depreciated by over four percent against these currencies.

- Weaker Canadian dollar: attributed to lower interest rates and weak economic sectors.

- Need for improved demand in credit-sensitive industries such as housing and construction.

Rosenberg concluded by expressing skepticism about the effectiveness of the Bank of Canada’s rate strategies, suggesting that more aggressive action may be necessary to invigorate the economy.

Implications for the Future

The path ahead seems fraught with uncertainty as Canada navigates its economic landscape. With inflation not deemed a critical issue and significant sectors stagnating, the outlook for recovery remains unclear. Stakeholders and policymakers must consider these factors seriously as they formulate strategies going forward.