Gold Price Today: Bullion Pulls Back Sharply After a Historic Spike, With Markets Digesting a Volatility Shock

Gold price today is reflecting a major shift in tone after a rapid surge that pushed the metal into record territory earlier in the week. With spot trading indicated around $4,865.35 per ounce and showing a steep daily decline, the bigger story is the violent swing in the day’s range, a sign that the market is transitioning from a smooth, momentum-driven rally into a choppier “risk-off within risk-on” phase.

Because it is Saturday, January 31, 2026 (ET), much of the “today” pricing is best understood as the latest available close and indicative levels rather than active, fully continuous trading across all venues. In other words: gold is still being priced, but parts of the market are in weekend mode, which can magnify gaps and exaggerate intraday ranges.

Gold price today: the latest levels investors are watching

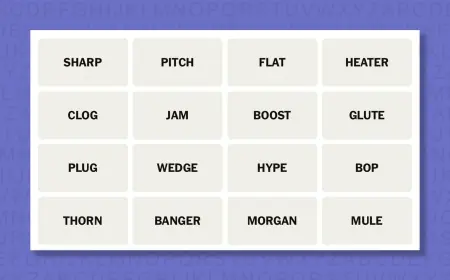

The latest published snapshot shows:

-

Spot gold (XAU per US dollar): $4,865.35/oz, down $530.53 (-9.83%)

-

Day’s range: $4,696.48 to $5,451.20

-

-

Gold futures: $4,763.10/oz, down $612.00 (-11.39%)

-

Day’s range: $4,737.80 to $5,500.90

-

Those ranges matter as much as the headline price. A market that can swing hundreds of dollars per ounce in a single session is a market where positioning and liquidity — not just fundamentals — can dominate short-term direction.

What happened: from record highs to a fast air pocket

In the last few trading sessions, gold moved into uncharted territory, briefly topping $5,500 per ounce before reversing. The latest data show that the move didn’t simply cool off — it snapped lower, with spot and futures both posting double-digit percentage declines from the prior close.

This kind of reversal often reflects a combination of:

-

profit-taking after an unusually steep rally

-

margin-driven selling in futures as volatility surges

-

stop-loss cascades once key technical levels break

-

thin liquidity windows that amplify each push lower

It’s not a verdict on gold’s long-term role — it’s the market’s way of clearing excess leverage and re-pricing risk in real time.

Behind the headline: why gold can fall hard even when demand looks strong

Gold is a hybrid asset: part currency alternative, part crisis hedge, part momentum trade. When it rises quickly, it attracts participants with different incentives that can become unstable when the direction flips.

Incentives and constraints at work right now:

-

Momentum and trend-following traders tend to add exposure on breakouts. When the breakout fails, exits can be fast and crowded.

-

Options hedging flows can accelerate selling when prices pass through large “strike zones,” forcing dealers and funds to rebalance.

-

Real-yield and dollar sensitivity means gold can reprice quickly if investors suddenly believe the path of interest rates or the currency has shifted.

-

Weekend effects can exaggerate moves. When parts of the market are closed, price discovery can migrate to fewer venues, and volatility can spike on less volume.

The net effect: even in a world where some investors want gold for protection, the short-term tape can still be dominated by forced selling and liquidity shocks.

Stakeholders: who gains, who loses, who has leverage

Gold’s whiplash hits different groups in different ways:

-

Long-term allocators (retirement portfolios, conservative diversifiers): may treat drops as a rebalancing opportunity, but only if volatility stabilizes.

-

Leveraged futures traders and short-dated options players: face the highest risk of liquidation when swings widen and margin requirements rise.

-

Gold miners and mining-equity investors: can see amplified moves versus spot due to operating leverage and equity risk premiums.

-

Physical buyers (jewelry, industrial users, bullion accumulators): may step in on pullbacks, but often wait until prices stop “falling through air.”

-

Central banks and reserve managers: typically operate on longer horizons; sudden drops can shift timing rather than strategy.

What we still don’t know: the missing pieces to watch next

The market has delivered the move; now investors need the explanation. Key unknowns include:

-

whether the drop was primarily technical deleveraging or a broader macro re-pricing

-

how much speculative positioning has already been flushed out versus how much remains

-

whether physical demand appears quickly at lower levels, creating a durable floor

-

whether volatility remains elevated into the next full trading session, signaling continued stress

A practical tell will be whether gold can hold above the session lows that were posted during the sharpest part of the decline.

What happens next: 5 realistic scenarios with clear triggers

-

Stabilization and range trade: Prices chop sideways as sellers exhaust and buyers scale in. Trigger: repeated holds above recent lows and narrowing intraday ranges.

-

Sharp mean reversion bounce: A fast rebound driven by short covering and bargain buying. Trigger: reclaiming broken technical levels on higher volume.

-

Deeper correction leg: Another wave lower if forced selling isn’t finished. Trigger: a clean break below the recent session lows and poor rebound attempts.

-

Volatility cluster: Big swings continue without a clear trend as liquidity rebuilds. Trigger: wide daily ranges persist for multiple sessions.

-

Trend reassertion to new highs (later, not immediate): Possible if macro conditions re-favor gold and positioning resets. Trigger: rebuilding support, then breaking out with calmer volatility.

Why it matters: gold’s shockwaves reach beyond bullion

Gold is often treated as “portfolio insurance,” but insurance premiums rise when volatility rises. A sudden, steep drop can change hedging costs, force reallocations across commodities, and reshape risk sentiment — especially if investors start viewing the move as a sign that liquidity is thinning or that crowded trades are unwinding.

Gold price today is therefore less about one number and more about a message: the market just transitioned from a high-confidence uptrend into a higher-friction environment where liquidity, leverage, and positioning can dominate the next few sessions.