Gold Slump and Oil Retreat Drop TSX Futures Before Fed Chair Decision

Canada’s main stock index futures have experienced a decline as global market conditions shift. Key factors contributing to this slump include falling gold prices and retreating oil values. These changes come ahead of a critical decision regarding the next Federal Reserve Chair.

Market Movements and Implications

As of 5:50 a.m. ET, March futures on Toronto’s S&P/TSX Composite Index were down 1.01%. This dip follows a previous closure on Thursday, where the benchmark index recorded losses due to a decline in precious metal prices. Notably, the index is still projected to achieve a strong monthly gain of approximately 4.1%.

Gold Prices Drop

- Spot gold fell 6%, briefly dipping below $5,000.

- The U.S. dollar strength is influencing these movements.

- Despite the drop, gold remains on track for its largest monthly gain since 1999.

Market speculation intensified around the Federal Reserve’s leadership after a meeting between U.S. President Donald Trump and former Fed Governor Kevin Warsh. Warsh has previously criticized current Fed policy and called for a “regime change.”

Oil Prices Retreat

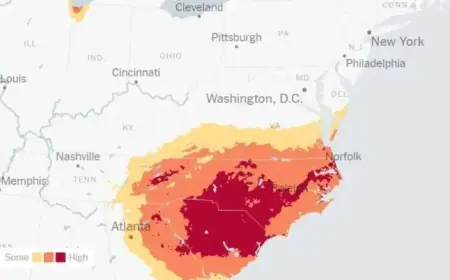

Oil prices also saw a decline with Brent crude futures falling by 1.2%, while U.S. West Texas Intermediate crude decreased by 0.9%. This decrease occurs amid reduced fears of supply disruptions related to the ongoing negotiations between the U.S. and Iran concerning its nuclear program.

Political Tensions and Market Responses

Accentuating the market’s instability, President Trump has expressed intentions to decertify Bombardier Global Express business jets. He has also threatened to impose 50% import tariffs on all Canadian-manufactured aircraft unless regulatory certifications are met for competing models from Gulfstream.

Certain analysts foresee significant impacts on Canadian markets due to these developments. With the impending appointment of a new Federal Reserve Chair and geopolitical uncertainties, traders are advised to monitor these evolving situations closely.