Key Insights for Canadian Investors Before the Bell Today

Today, Canadian investors should be attuned to several critical developments that may impact the financial landscape. Important earnings reports, currency fluctuations, and international economic indicators are shaping market sentiment.

Market Overview

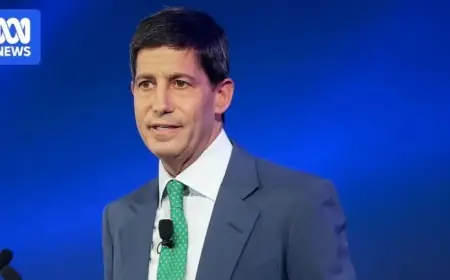

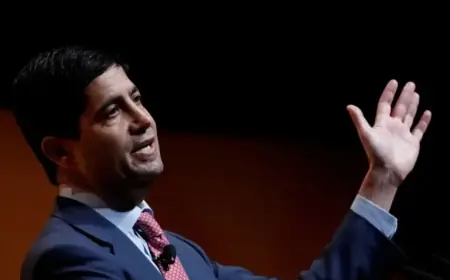

Global equity markets exhibited mixed performances. President Donald Trump’s announcement of Kevin Warsh as the next Federal Reserve chair has stirred investor interest. While Wall Street futures remain bearish, Canadian markets also followed suit due to falling commodity prices.

Key Earnings Reports

In Canada, key companies are releasing their results:

- Canadian National Railway Co.

- Imperial Oil Ltd.

- Brookfield Renewable Partners LP

- Brookfield Business Partners LP

Wall Street is also anticipating earnings from major corporations, including:

- Exxon Mobil Corp.

- Chevron Corp.

- American Express Co.

- Verizon Communications Inc.

Global Market Movements

On the international front, the European pan-index STOXX 600 saw a 0.8 percent increase in morning trading. Key indices performed as follows:

- FTSE 100 (UK): +0.51%

- DAX (Germany): +1%

- CAC 40 (France): +0.83%

- Nikkei (Japan): -0.1%

- Hang Seng (Hong Kong): -2.08%

Commodity Prices

Commodity markets are responding to geopolitical developments. Oil prices dropped, driven by indications of U.S.-Iran diplomatic dialogue. Current prices are as follows:

- Brent crude: US$70.03 per barrel

- WTI crude: US$64.70 per barrel

Additionally, spot gold saw a significant decline to US$5,124.37 an ounce, after reaching a peak of US$5,594.82.

Currency and Bond Movements

The Canadian dollar weakened against the U.S. dollar, trading between 73.77 cents and 74.17 cents. Over the past month, it has gained approximately 1.46% against the greenback. Concurrently, the U.S. dollar index increased by 0.29%, reaching 96.56.

The Canadian economic updates to monitor include:

- Real GDP for November (8:30 a.m. ET)

- U.S. product price index for December (8:30 a.m. ET)

Understanding these developments is essential for Canadian investors today. Stay informed with Filmogaz.com for the latest updates on financial markets and economic conditions.