Consider Buying Palantir Stock Ahead of Q4 Report

Investors may find Palantir Technologies (PLTR) an intriguing option as it approaches the announcement of its fourth-quarter fiscal 2025 earnings on February 2, 2025. Initially focused on data analytics for government and defense, Palantir is now recognized as a pivotal enterprise artificial intelligence (AI) platform. Its evolving business model has captured significant attention, but is it the right time to buy?

Growth Drivers: Palantir’s AI Segment

Palantir’s Artificial Intelligence Platform (AIP) is emerging as a primary catalyst for growth. In the third quarter of 2025, U.S. commercial revenues surged by 121% year over year, reaching $397 million. This increase stemmed from the widespread adoption of AIP, not only for focused applications but for extensive enterprise-wide transformations.

- AIP Bootcamps allow clients to implement AIP in rapid production-grade use cases, reducing sales cycles.

- Service advancements, including AI FDE and AI Hivemind, enhance the platform’s capabilities.

AI Innovations Driving Revenue

Palantir’s innovations in agentic AI are pivotal. The AI FDE development agent connects to diverse data sources, integrates this data, and builds enterprise applications at impressive speeds. AI Hivemind helps orchestrate solutions, serving to refine ideas and generate executable proposals. These innovations, along with Edge Ontology, are strengthening the value proposition of AIP.

Government Contracts Enhance Stability

The government sector is also a substantial growth avenue for Palantir. In August 2025, the company secured a contract valued at up to $10 billion from the U.S. Army, which consolidates numerous legacy contracts into a single agreement that spans the next decade. This deal has significantly improved revenue visibility and standardization of Palantir’s software within military operations.

- In December 2025, the U.S. Navy endorsed a $448 million commitment to implement Palantir’s Foundry and AIP in the Maritime Industrial Base.

- Analyst Tyler Radke from Citigroup anticipates Palantir’s government revenue will grow by 51% year over year in fiscal 2026.

Financial Standing and Market Outlook

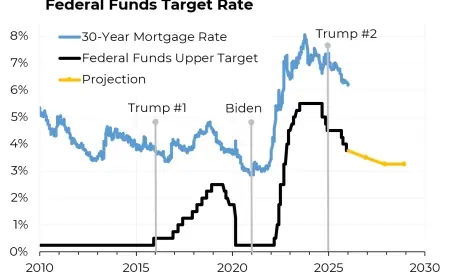

Palantir is already generally accepted accounting principles (GAAP) profitable and has posted a positive free cash flow. Moreover, the company’s inclusion in the S&P 500 index in 2024 has bolstered institutional ownership, thereby reducing volatility linked to market sentiment.

Valuation Concerns

Despite these positive factors, Palantir’s high valuation remains a concern. The stock trades at approximately 167.2 times its forward earnings, an expensive multiple. This elevated valuation leaves minimal leeway for missteps in performance or a weaker-than-expected outlook.

Retail investors should proceed with caution. While Palantir exhibits solid fundamentals, the premium pricing necessitates careful position sizing to accommodate potential volatility. Adopting a dollar-cost-averaging strategy might be prudent, allowing investors to gradually increase their holdings over time.

As the upcoming Q4 2025 earnings report approaches, potential investors need to weigh the benefits against the risks of investing in Palantir stock.