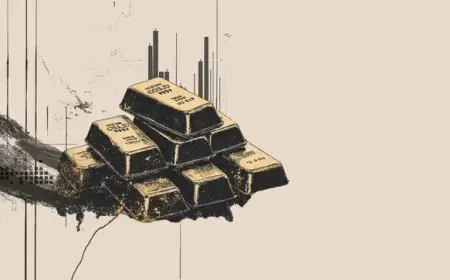

Gold Price Today Surges Toward $5,300 as a Weaker Dollar and Fed Pause Push Bullion to Fresh Records

Gold price today is flashing a new milestone for 2026: by late morning Wednesday, January 28, 2026 ET, spot gold was trading in the neighborhood of $5,280 to $5,320 per ounce after notching fresh record highs earlier in the session. The move extends a blistering start to the year for bullion, with gains now running north of 20% in 2026 as investors crowd into perceived “hard” assets amid currency anxiety, geopolitical risk, and a Federal Reserve that just signaled it is in no hurry to change course.

The rally is not happening in isolation. Gold is climbing alongside a broad reassessment of what “stable” looks like in global markets: a softer dollar, louder political pressure on monetary policy, and persistent uncertainty about inflation’s next direction.

Gold Price Today: What moved the market

Three forces dominated Wednesday’s tape:

1) The dollar’s slide and confidence shock

Gold tends to benefit when the dollar weakens because bullion is priced globally in dollars; a cheaper dollar can make gold more attractive to non-U.S. buyers and can also act as a signal that investors are hedging currency risk. This week’s selling pressure on the dollar has been sharp enough to reprice the entire “safe haven” complex, with gold the most direct beneficiary.

2) The Fed meeting and “wait-and-see” messaging

The Fed held its policy rate steady at 3.50% to 3.75% at the conclusion of its January meeting, emphasizing that inflation remains “somewhat elevated” while job gains have cooled. The Fed’s pause matters for gold because it keeps the market focused on what comes next: if investors believe rate cuts are coming later in 2026, that can cap real yields and reduce the opportunity cost of holding a non-yielding asset like gold. The split within the committee also reinforces the idea that policy is contested rather than predetermined.

3) Safe-haven demand in a headline-driven world

Gold rallies hardest when uncertainty feels unpriceable. When geopolitics, policy shifts, or credibility concerns around institutions rise to the surface, bullion often absorbs that stress because it sits outside any one government’s promise to pay. Even investors who don’t view gold as a long-term store of value may treat it as short-term insurance.

Behind the headline: Why this gold move is different from a typical “risk-off” pop

This isn’t a one-day panic bid. The scale and speed of the move suggests something more structural is underway.

Context

Gold’s climb has been supported by a multi-year shift in demand patterns: heavier official-sector interest, a renewed focus on reserve diversification, and a market that increasingly prices policy credibility as a variable rather than a constant. When trust becomes a moving target, tangible assets gain narrative power.

Incentives

-

Central banks have incentives to diversify reserves and reduce vulnerability to financial shocks.

-

Investors have incentives to hedge both inflation risk and policy risk, especially when fiscal and monetary debates feel less predictable.

-

Consumers (jewelry and small-bar buyers) often step in when prices are rising, but they can also step out quickly if the move feels too fast, creating sharp short-term swings.

Stakeholders

A gold spike reverberates well beyond traders. It affects jewelry demand, mining equities, currency-sensitive importers, and even policymakers watching inflation expectations. It also changes the psychology of markets: once gold breaks into new price territory, “anchoring” disappears and volatility can increase because there is no recent reference point to calm buyers and sellers.

Second-order effects

-

Higher gold can tighten financial conditions for some emerging markets by signaling global risk aversion.

-

It can amplify political pressure on central banks if the rally is interpreted as a “vote of no confidence” in currency stability.

-

It can draw speculative money that accelerates moves in both directions, raising the odds of abrupt pullbacks.

What we still don’t know

Despite the headline-making numbers, several missing pieces will determine whether this rally holds or snaps back:

-

How the dollar behaves after the Fed’s press conference tone is fully digested

-

Whether real yields drift lower or rebound as markets reprice the path of cuts

-

How strong physical demand is at these levels, especially in key buying regions where consumers can turn price-sensitive

-

Whether official-sector buying remains steady or slows as prices jump

-

How much of the move is positioning and momentum, which can reverse quickly if the narrative shifts

What happens next: 5 realistic scenarios with clear triggers

-

A controlled pullback and consolidation

Trigger: the dollar stabilizes and yields tick higher, cooling momentum without breaking the longer-term bid. -

A continuation rally toward the next psychological round number

Trigger: markets price earlier or deeper rate cuts, or the dollar resumes a renewed downtrend. -

A sharp, air-pocket selloff

Trigger: crowded positioning meets a sudden dollar rebound, hawkish surprises, or a wave of profit-taking after record highs. -

Choppy sideways trade with violent intraday swings

Trigger: uncertainty stays high, but buyers and sellers reach temporary equilibrium as new information arrives day by day. -

A broader re-rating of “hard assets” beyond gold

Trigger: inflation expectations firm up again or policy credibility becomes the dominant macro theme, pulling more capital into commodities and inflation hedges.

Why it matters

Gold’s surge is a message embedded in a price: investors are paying up for insurance. For households, it can signal rising uncertainty around inflation and currency value. For businesses, it can foreshadow more volatility in costs and financing conditions. And for markets, it’s a reminder that “risk-free” assumptions are being debated in real time.

Gold price today isn’t just a number on a screen. It’s a live referendum on confidence—and right now, confidence is expensive.