Gold Surges to $5,400 Amid Fed Decision and Dissenters’ Breakout

The gold market has experienced a significant surge, with prices climbing to unprecedented levels amid developments from the Federal Reserve. The price of gold (XAU/USD) reached a remarkable $5,412, marking an increase of over 4% during the North American trading session. This upward trend follows the Federal Reserve’s decision to maintain interest rates, though with notable dissent among policymakers.

Federal Reserve’s Rate Decision and Impact on Gold

The Federal Reserve decided to keep its interest rates unchanged between 3.50% and 3.75%, following a split vote of 10-2. Notably, two dissenting members advocated for a 25 basis point cut. This split reflects ongoing debates within the Fed concerning the economic outlook and monetary policy.

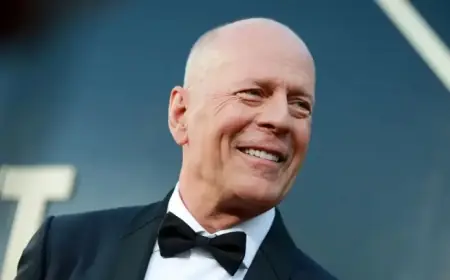

Despite the unchanged rates, Fed Chair Jerome Powell maintained a neutral tone, emphasizing the Fed’s data-dependent approach. He noted that while the labor market is stabilizing, inflation remains elevated, with core Personal Consumption Expenditures (PCE) anticipated to peak around mid-year, reaching closer to 3%.

Geopolitical Influences and Market Reactions

Market dynamics have also been shaped by recent geopolitical events. Concerns surrounding US-Iran relations continue to enhance gold’s appeal as a safe-haven asset. Concurrently, President Trump announced tariff adjustments affecting Canadian goods contingent on trade negotiations with China, further influencing market sentiment.

Following the announcement from the Fed, the US Dollar Index (DXY) showed modest gains, increasing by 0.58% to 96.37. This was despite gold’s remarkable performance, which typically inversely correlates with rising Treasury yields.

- Current Gold Price: $5,412

- Change in Price: +4%

- Interest Rates Held: 3.50% – 3.75%

- Vote Split: 10-2

- Expected Core PCE Near: 3%

- Gold Year-to-Date Increase: 24%

Market Outlook for Gold

Gold’s trajectory suggests a continuous upward movement, potentially challenging the psychological resistance at $5,500. Should the price retrace, initial support is anticipated at $5,250, followed by $5,200. The momentum indicates that buyers remain optimistic about gold’s stability as a safe investment amid ongoing uncertainties.

Understanding the Federal Reserve’s Role

The Federal Reserve plays a crucial role in shaping US monetary policy. Its two primary mandates are achieving price stability and promoting full employment. Adjustments in interest rates are the primary mechanism for fulfilling these goals. The Fed convenes regularly, with the Federal Open Market Committee (FOMC) assessing economic conditions and determining policy directions.

While the Fed opted against further rate cuts, the market is closely monitoring conditions, with money markets indicating a 95% chance of maintaining current rates this year. Traders are watching for a potential easing of 46 basis points in the future.

The evolving landscape indicates that gold will continue to be a focal point for investors, especially amid fluctuating economic conditions and geopolitical uncertainties.