Canadian Firms Cautious as Takeover Interest Rises, Bank of America Reports

Canadian companies are growing more cautious as takeover interest from foreign buyers increases, especially in the wake of a declining dollar and lower interest rates. This trend underscores a shift in approach, according to Deep Khosla, the head of Canadian investment banking at Bank of America.

Investment Landscape in Canada

The Canadian dollar has weakened against the U.S. dollar, making domestic firms more appealing to foreign investors. Concurrently, interest rates in Canada are comparatively low, resulting in heightened cross-border merger and acquisition activity. Last year, Canada ranked as the third-largest target for such activities globally, trailing only behind the United States and the United Kingdom.

Defensive Strategies for Canadian Firms

- Bank of America emphasizes readiness against aggressive takeover bids.

- Clients are encouraged to adopt a defensive posture to counter potential opportunistic offers.

Mr. Khosla mentioned that this proactive strategy allows companies to shift to an offensive stance as potential acquirers. The rising geopolitical tensions have raised concerns in Ottawa regarding foreign investment and shareholder activism.

Changes in Foreign Investment Rules

In March 2025, the Canadian government extended its authority to block foreign investments to shield national interests. This decision arose amid escalating tariff disputes with the U.S. The revised guidelines specifically address concerns over investments that could threaten Canada’s economic security.

Increase in Shareholder Activism

While shareholder activism has been a dominant force in the U.S., it is becoming more noticeable in Canada. Bank of America is advising its clients to prepare for this shift.

- Prominent deals include the acquisition of Parkland Corp. by Sunoco LP for $9.1 billion.

- Rogers Communications sold a minority stake in its wireless infrastructure for $7 billion in a friendly deal with Blackstone Inc.

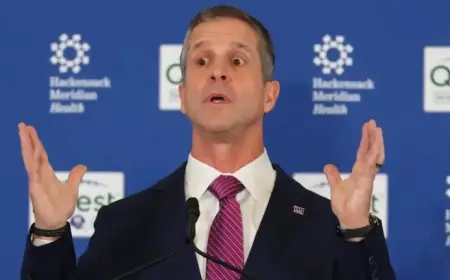

Bank of America’s Commitment to Canada

Bank of America, one of the 16 U.S. banks operating in Canada, has significant assets in the country, amounting to about $113 billion. The firm is actively expanding its Canadian operations. Last year, it hired over 140 employees, reinforcing its commitment to the market.

Drew McDonald, the president of Bank of America Canada, highlighted the bank’s long-term dedication and ongoing growth in the region. The increase in workforce demonstrates the bank’s confidence in the Canadian market and its evolving investment landscape.