Reeves Rejects Pubs’ Temporary Tax Resolution

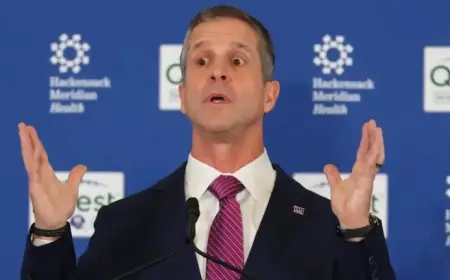

In a significant move, Shadow Chancellor Ms. Reeves appears poised to announce a temporary resolution for pubs facing economic challenges, particularly in light of the upcoming World Cup.

Temporary Tax Resolution for Pubs

According to industry insiders, Ms. Reeves plans to unveil changes shortly, potentially aligning with a government initiative to ease licensing regulations during the closely watched event. This follows growing pressure from Labour MPs who demand at least a 20 pence reduction in rates specifically for pubs.

Chancellor’s Previous Considerations

Recently, the Chancellor suggested a reassessment of her proposal to increase rates imposed on Britain’s pubs. A support package that caters exclusively to these establishments is anticipated, yet critics highlight that the rest of the hospitality sector remains unaddressed.

Industry Concerns About Relief Measures

- Experts contend that any relief is expected to be temporary, insufficient for long-term recovery.

- Business leaders report discussions include possibilities of a more extensive cap on rising costs or a more significant permanent discount on rates.

- Insiders remain skeptical about the proposals effectively supporting pubs.

One industry source expressed doubts, stating that the measures would likely be “too narrow and too shallow” to meaningfully alleviate the burdens faced by pubs. The concerns echo the sentiments of Labour MPs who emphasize the necessity of these community hubs, particularly in rural regions, where they provide critical employment opportunities.

The Ongoing Challenges for Pubs

Pubs in the UK have been grappling with numerous challenges since Ms. Reeves’ initial tax-increasing budget announced in October 2024. These establishments face escalating energy costs, with the UK experiencing higher expenses than many other developed countries.

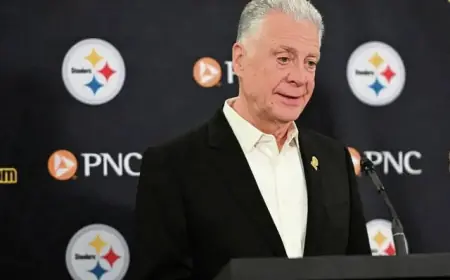

Sir Mel Stride, the Shadow Chancellor, has voiced concerns, stating that the prevailing fears surrounding business rates are detrimental to the health of high streets across the nation.

A Commitment to Support

In response, a spokesperson from HM Treasury indicated that the government is providing a £4.3 billion support package aimed at alleviating bill increases. This initiative includes efforts to cap Corporation Tax at 25%, reduce bureaucratic obstacles, and address the overall cost of living.