Trump’s Tariff Threats over Greenland Shake Treasury Market to Months’ Worst

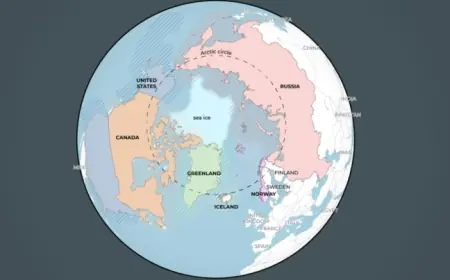

On January 20, 2026, U.S. Treasury markets faced significant turbulence as President Donald Trump announced a 10% tariff on imports from eight European nations. This unexpected move led to increased anxiety among investors, triggering a sell-off in the government debt market.

Impact on Treasury Yields

The reaction to Trump’s tariff threats was immediate. During trading on Tuesday, the 10-year Treasury yield rose by as much as 8.1 basis points. It reached an intraday peak of 4.31% before settling at a five-month high of 4.29%. The data reflects a gain of 6.4 basis points for the day, according to figures from Dow Jones Market Data.

30-Year Bond Performance

The long-term 30-year bond experienced an even more dramatic decline. It recorded its largest single-day drop since July 11, amid fears of escalating trade disputes with Canada and Europe. On this particular day, the 30-year yield surged 11.2 basis points to a high of 4.95%, ultimately concluding at 4.92%, an increase of 8.1 basis points in U.S. trading.

Understanding Market Dynamics

- Bond prices and yields have an inverse relationship.

- During periods of aggressive selling, yields tend to rise sharply.

The day’s trading underscored the sensitivity of the Treasury market to political developments and trade policy changes. As tariffs loom, the market anticipates further volatility in response to government actions.