Former Fidelity Star Warns on OpenAI, Advises Investors to Secure Assets

In a recent advisory, a former Fidelity star manager has raised alarms about OpenAI. He warns investors to take precautions with their assets, particularly in light of the rapid changes occurring within the tech landscape.

OpenAI’s Current Financial Landscape

OpenAI has reportedly achieved impressive revenue figures, hitting $20 billion. However, the associated costs of sustaining such growth could pose significant challenges moving forward.

Growth vs. Sustainability

While the revenue growth is notable, it raises questions about long-term sustainability. The finance chief of OpenAI, Sarah Friar, has indicated a shift in focus towards “practical adoption” by the year 2026. This insight suggests that the company recognizes the need to balance rapid growth with practical and viable strategies.

Expert Advice for Investors

In light of these developments, the former Fidelity manager advises investors to be cautious. He emphasizes the importance of securing assets in today’s volatile market conditions. His recommendations include looking into more stable assets that can withstand fluctuations in the tech sector.

Recommended Asset Types

- Real estate investments

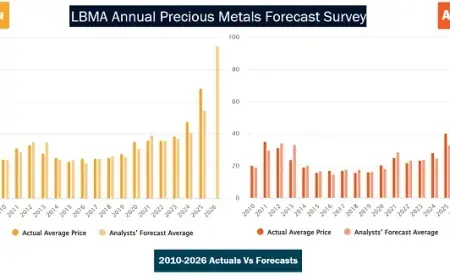

- Precious metals such as gold and silver

- Dividend-paying stocks for steady income

Such asset classes may offer more security during uncertain economic times. As investors make decisions, they should remain aware of the potential risks associated with tech investments like OpenAI.

Conclusion

As OpenAI navigates its financial future and shifts strategies, investors must remain vigilant. Ensuring asset protection and making informed decisions should be a priority in the current market environment. For more insights and the latest developments, stay tuned to Filmogaz.com.