Urgent $38 Trillion Dollar Collapse Warning Shakes Gold and Bitcoin Markets

Recent developments have raised alarms across financial markets, signifying a potential $38 trillion dollar collapse that threatens to destabilize both gold and Bitcoin. As geopolitical tensions rise, analysts are closely monitoring these two asset classes, which have demonstrated adverse reactions to ongoing economic conditions.

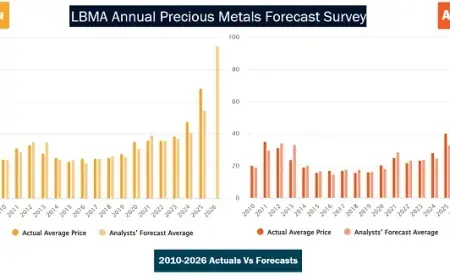

Gold Reaches New Heights Amid Economic Turbulence

Gold prices have soared to record levels, with some forecasts predicting they could reach $5,000 per ounce. This surge is largely attributed to the increasing volatility of the U.S. dollar, especially as it faces pressures from trade wars and inflation concerns.

Warnings from Industry Leaders

Billionaire investor Ray Dalio, founder of Bridgewater Associates, highlighted the decline of the U.S. dollar as the global reserve currency. He emphasized that the existing economic order is facing serious challenges, which could lead to wars and significant geopolitical shifts.

- Dalio’s predictions stem from analyzing five critical forces: economic cycles, domestic disorder, great power conflicts, acts of nature, and technological advancements.

- Last year, the U.S. dollar lost nearly 10% value, impacting investor confidence.

- In January 2023, the dollar was projected for substantial declines due to ongoing inflation issues.

Bitcoin Experiences Significant Declines

In contrast to gold’s rise, Bitcoin recently plummeted from nearly $96,000 to just over $90,000. Analysts noted this decline occurred amid heightened tariffs announced by former President Donald Trump, which adversely affected Bitcoin as an investment.

According to market experts, Bitcoin has been behaving more like a high-risk asset rather than a safe haven during these turbulent times. The correlation between market confidence and Bitcoin’s price was stark, as its decline coincided with increasing tensions in the trade landscape.

Economic Indicators and Future Prospects

Upcoming inflation readings are anticipated to be higher than initially expected, amplifying fears of stagflation—where slow economic growth is coincident with rising prices.

- The U.S. personal consumption expenditures price index (PCE) forecast for December is projected to be around 2.8% to 2.9%.

- Market analysts from Barclays and Morgan Stanley have adjusted their predictions, anticipating significant fluctuations in consumer prices.

Conclusion: A Volatile Market Landscape

The intersection of political maneuvering and economic indicators suggests a precarious future for both Bitcoin and gold. As doubts rise regarding the stability of the U.S. dollar and the broader financial system, investors are urged to exercise caution. The potential $38 trillion dollar collapse looms, signaling an urgent need for strategic positioning within this evolving landscape.