Davos 2026: Greenland tension, rule-of-law warnings, and Middle East diplomacy dominate the agenda midweek

Davos is once again acting as a pressure chamber for global politics and markets, with the annual late-January gathering in the Swiss Alps turning into a live test of alliances, trade nerves, and the future of global rules. By Wednesday, January 21, 2026, the meeting’s core theme—keeping dialogue alive in a fractured world—has been challenged by a surge of hard-power headlines, from the transatlantic fallout tied to Greenland to stark warnings that international norms are eroding.

This year’s summit runs January 19–23, 2026, and the unusually large presence of senior leaders has amplified the sense that Davos is not just a networking ritual, but a place where governments try to shape narratives while investors and CEOs attempt to price what comes next.

Davos and the Greenland dispute: a geopolitical shadow over the Alps

One issue has followed delegations through nearly every hallway conversation: the escalating argument over Greenland and what it signals about the durability of the Western alliance. European officials have arrived bracing for sharper U.S.-Europe friction, and the tone has been noticeably less “policy seminar” and more “damage control,” with diplomatic language tightening around sovereignty, deterrence, and credibility.

The practical concern isn’t only Greenland itself. It’s the knock-on effects:

-

Whether alliance commitments become transactional

-

Whether security guarantees are treated as bargaining chips

-

Whether economic cooperation weakens under geopolitical pressure

For business leaders, the Greenland dispute is being interpreted as another sign that geopolitics is now a first-order economic variable—affecting investment decisions, supply chains, and currency expectations as much as inflation or interest rates.

Leaders warn of a world “without rules” as uncertainty rises

A major through-line of Davos 2026 has been the argument that the international system is moving away from predictable rules and toward raw leverage. France’s president delivered one of the meeting’s most pointed interventions, describing a shift toward a world where norms and law are less respected and where “imperial” ambitions are returning.

That message resonated because it aligns with what many delegates are already feeling: overlapping stress tests are hitting at once—war and ceasefire fragility in the Middle East, unresolved conflict in Europe, and intensifying competition over trade, technology, and strategic territory.

For markets, “world without rules” is not a slogan; it translates into tangible risk premiums. When the rules are unclear, companies stockpile inventory, demand higher returns, delay projects, and restructure supply lines—actions that can slow growth and keep price pressures sticky.

Europe’s pitch: competitiveness, defense, and industrial resilience

European institutions have used Davos to push a more urgent narrative about competitiveness and security. The message being delivered is that Europe cannot rely on yesterday’s assumptions—cheap energy, frictionless trade, and stable security architecture—and must invest more aggressively in strategic industries and defense readiness.

The subtext is equally important: Europe is signaling it intends to be a rule-setter, not merely a rule-taker, as the U.S. and China shape the next era of industrial policy and technology standards. Expect this theme to harden in the months ahead as election cycles, fiscal constraints, and energy realities collide.

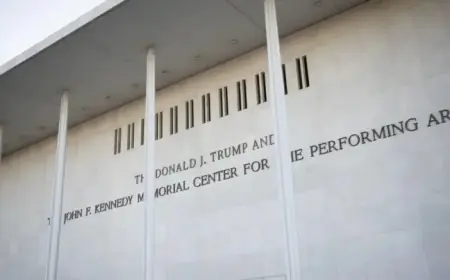

Trump’s Davos moment: travel disruption adds to the drama

Davos also turned into a travel headline after the U.S. president’s flight experienced a minor electrical issue that forced a turnaround and delayed arrival. The incident itself appears logistical rather than strategic, but it added to the broader sense of volatility around the U.S. posture being discussed in Davos.

What matters more than the flight story is the political atmosphere surrounding the president’s appearance: European leaders are preparing for direct messaging on alliances, burden-sharing, and trade, while U.S. officials are trying to keep the focus on domestic affordability and economic performance. Davos rarely changes policy on the spot, but it can accelerate a narrative—and narratives often become policy.

Middle East diplomacy enters the Davos spotlight

The Middle East has remained central to the week’s agenda, with Egypt’s president using a Davos session to frame the launch of a second phase in a Gaza ceasefire as a pivotal step toward regional de-escalation. The intervention underscores a broader Davos pattern: even at an economic summit, security and humanitarian dynamics are now inseparable from investment, energy planning, and political stability.

Delegates have been watching for two signals:

-

Whether ceasefire steps are durable enough to reduce regional spillover risk

-

Whether major powers can coordinate rather than compete in mediation efforts

Even incremental progress can affect energy sentiment, shipping risk perceptions, and broader regional confidence—areas that markets tend to reprice quickly.

What to watch next through Friday

With two days still left in the meeting, Davos is heading into its most consequential stretch—when private bilateral talks and late-stage panels can sharpen policy direction. The most likely developments to drive fresh headlines are:

-

Any explicit commitments (or warnings) on alliance security and defense spending

-

Trade and tariff messaging that could reshape 2026 corporate planning

-

Signals on conflict de-escalation efforts and humanitarian access

-

New framing on technology controls, industrial subsidies, and supply-chain “friend-shoring”

Davos 2026 is unfolding less like a calm checkpoint and more like a live diagnostic of the global system: alliances strained, rules contested, and markets forced to adapt to politics that moves faster than boardrooms prefer.