Trump’s Quest for Cheaper Oil May Cost Texas Dearly

Texas’ oil and gas sector is experiencing challenges due to fluctuating oil prices. Following the economic devastation caused by COVID-19, the industry saw a rebound. By 2024, production reached record levels with oil prices exceeding $70 per barrel, generating significant tax revenue for the state, schools, and local authorities.

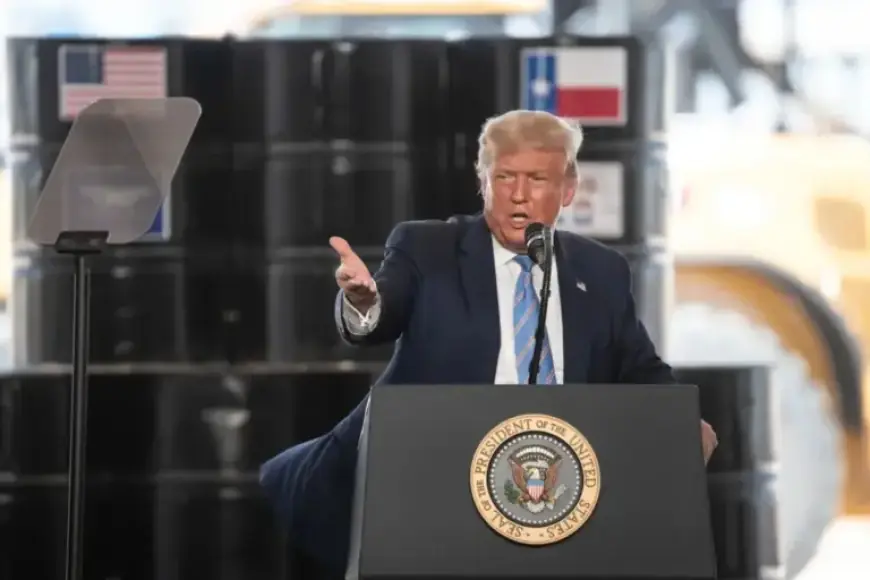

Impact of Trump’s Oil Price Plan

However, President Donald Trump’s commitment to lowering oil prices to $50 per barrel could jeopardize this recovery. Experts warn that this shift might disrupt the Texas oil and gas sector, which employs about 495,000 workers.

Potential Economic Consequences

The suggestion of flooding the market with oil from countries like Venezuela could further harm Texas’ economy. Tom Manskey, the economic development director for Odessa, emphasizes that lower prices could cripple job markets and local tax revenues.

- Odessa’s population: approximately 120,000.

- Key employer: oil and gas industry.

- Potential job losses predicted if prices drop significantly.

Ray Perryman, an economist, indicates that a decline in oil prices could lead to major shifts in market dynamics, affecting both short and long-term stability. Reduced oil activity in areas like the Permian Basin would resonate through sectors such as housing and retail.

Market Adjustments and Industry Responses

Despite these concerns, some industry leaders retain an optimistic outlook. Ed Longanecker, president of the Texas Independent Producers and Royalty Owners Association, notes that existing techniques, such as horizontal drilling, allow continued access to oil resources.

- Current drilling cost requirement: $62 per barrel.

- Flat production estimate: 5.8 million barrels per day through late 2025.

- Decline in drilling rigs: 20 since Trump took office.

Todd Staples, president of the Texas Oil and Gas Association, argues the industry has a history of navigating price volatility. He notes that ongoing adaptations and innovations will help maintain competitiveness amidst market fluctuations.

Long-term Predictions

Analysts suggest that if oil prices reach $50 or lower, there could be severe repercussions. Dane Gregoris, managing director of Enverus, warns that prices below this threshold may prompt significant operational cutbacks among oil producers.

A reduction in production not only threatens oil companies but also local economies reliant on this industry. Odessa’s Chamber of Commerce president, Renee Earls, emphasizes the interconnected nature of the economy, highlighting the importance of stability in oil pricing for all sectors.

The outlook remains uncertain, and local leaders hope for a balanced market to avoid repeating past economic struggles faced in West Texas.