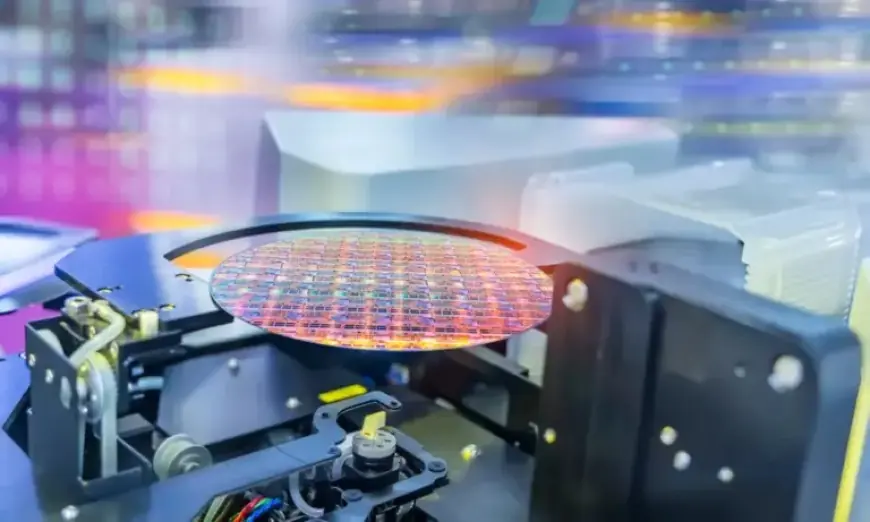

Taiwan Semiconductor Stock Soars Amid AI Chip Demand: Buy More or Sell?

Taiwan Semiconductor Manufacturing Company (TSMC) has made headlines with its impressive performance, primarily driven by skyrocketing demand for artificial intelligence (AI) chips. Following robust quarterly results, TSMC’s stock rose significantly. This article explores the latest developments and assesses whether this is the right moment to buy more, or reconsider holding.

Exceptional Growth and Market Position

TSMC’s stock has seen an increase of around 70% over the past year. The company recently reported fourth-quarter revenue of $33.7 billion, marking a nearly 26% rise. This growth is primarily fueled by its leadership in advanced semiconductor manufacturing.

Key Financial Metrics

- Current Price: $328.29

- Market Capitalization: $1.8 trillion

- Day’s Price Range: $328.18 – $342.09

- 52-Week Price Range: $134.25 – $351.33

- Gross Margin: 62.3%

- Dividend Yield: 0.90%

Unrelenting Demand for AI Chips

The growth of AI technology continues to drive demand for high-performance semiconductor chips. TSMC projects its capital expenditures for this year will reach between $52 billion and $56 billion, significantly surpassing analyst estimates of around $41 billion for 2026.

Management indicates that major cloud computing firms are committed to continued high spending. This is essential for meeting their substantial capacity demands.

Technical Advancements

- 77% of TSMC’s revenue comes from chips with nodes of 7 nanometers and below.

- The latest 3-nm technology contributed 28% to total wafer revenue.

- High-performance computing (HPC) comprises 55% of quarterly revenue.

Profitability and Margin Expansion

TSMC’s earnings per American depositary receipt (ADR) rose to $3.14, reflecting a 40% increase from the previous year’s $2.24. Its gross margin has improved by 330 basis points to 62.3%, outpacing earlier forecasts.

The company anticipates first-quarter gross margins will range between 63% and 65%, indicating strong profitability despite potential challenges from overseas operations.

Future Outlook

Looking ahead, TSMC projects first-quarter revenue between $34.6 billion and $35.8 billion, representing nearly 38% year-over-year growth. The company’s forecast for full-year revenue growth stands at about 30%.

To Buy or Not to Buy?

With its strong financial performance and strategic market position, TSMC appears well-poised for continued growth. The company’s attractive valuation, with a forward price-to-earnings (P/E) ratio below 21, suggests that its stock may be undervalued, especially with a PEG ratio of 0.7.

Investors may find TSMC to be a compelling opportunity to consider buying more shares rather than selling, given its robust prospects in the expanding AI market.