Ray Dalio Warns: Can Gold Replace US Dollar’s Reserve Status by 2025?

Ray Dalio has warned that significant changes to the global monetary system could occur by 2025. His insights come as U.S. debt continues to soar and global growth slows amid increasing trade tensions.

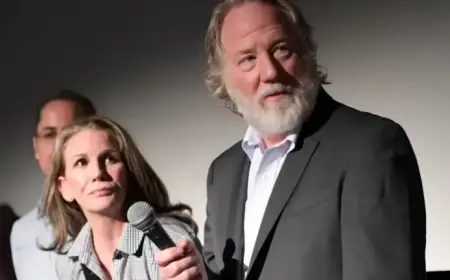

Dalio’s Insights on Global Economic Disruption

In a resurfaced NBC interview from April 2025, Dalio identified five key factors that could disrupt the global economic landscape. These factors include:

- Debt cycles

- Internal conflicts

- Geopolitical shifts

- Acts of nature

- Technological advancements

Dalio expressed concern that these influences might lead to a breakdown of the existing monetary order, beyond what would be expected from a typical recession. The founder of Bridgewater Associates emphasized the ongoing fiscal strains and trade tensions facing the U.S.

Concerns Regarding U.S. Debt

Dalio pointed out the alarming rate of national debt accumulation, noting that tariffs imposed on China serve as disruptors in the global production system. He warned of potential chaotic consequences, which could mirror economic crises from previous decades like those in 1930, 1971, or 2008.

In his analysis, Dalio suggested that a budget deficit of 3% of GDP could help mitigate some of these issues, a significant shift from the current annual shortfalls nearing $2 trillion. Currently, the U.S. debt-to-GDP ratio stands at 124%.

Current Global Economic Context

As of early 2026, the U.S. has accumulated $602 billion in borrowings in just the first three months. The national debt is approaching $38 trillion, intensifying concerns over debt-driven devaluation. Dalio reiterated that the challenges presented by tariffs, particularly those enacted during the Trump administration, are inhibiting global growth, which is estimated to slow to between 2.7% and 2.9%.

Impact of Tariffs on Trade and Labor Markets

Dalio noted that these tariffs, while aiming for understandable economic goals, are being executed in ways that exacerbate global tensions. Significant impacts are being felt particularly in labor markets across Europe and China, where trade contracts by about 2.2%.

The Rise of De-Dollarization

Advancements from BRICS nations suggest a trend toward de-dollarization. Proposals like India’s Reserve Bank Initiative for linked digital currencies and prototypes like “BRICS Pay” reflect a shifting financial landscape.

Central banks worldwide are increasingly turning to gold. In 2026, global gold reserves reached nearly $4 trillion, surpassing U.S. Treasury holdings of approximately $3.9 trillion for the first time since 1996. This trend indicates a pivotal move away from dollar assets.

Conclusion

Dalio’s predictions may hint at a significant transformation by 2025 in how nations view and utilize currency. As global economic dynamics evolve, the potential for gold to replace the U.S. dollar’s reserve status is becoming more plausible.