Trump’s Tax Policy Fuels Trillion-Dollar Trend Favored by Apple, Alphabet, Nvidia

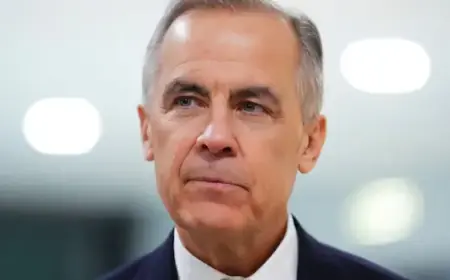

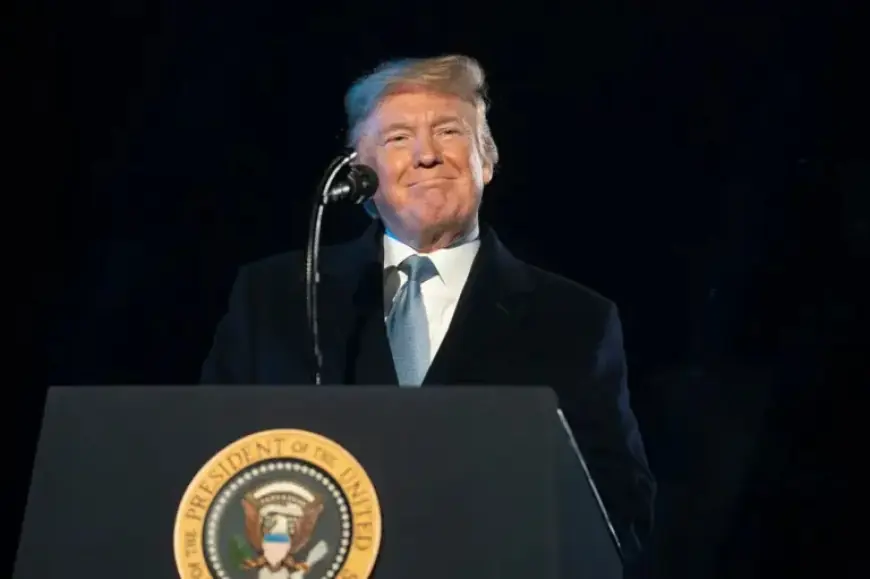

In recent years, the stock market has witnessed significant trends, catalyzed in part by Donald Trump’s tax policy. While artificial intelligence (AI) remains a key player in market dynamics, Trump’s fiscal decisions have also left a lasting impact on Wall Street. In 2025, the S&P 500 index experienced a 16% increase, achieving notable gains amidst tumultuous market conditions.

Trump’s Tax Policy and its Market Impact

Trump’s presidency, spanning January 20, 2017, to January 20, 2021, saw substantial growth in major stock indices. The Dow Jones Industrial Average rose by 57%, the S&P 500 by 70%, and the Nasdaq Composite surged by 142%. One of the pivotal elements of this growth was the Tax Cuts and Jobs Act (TCJA) enacted in 2017. This legislation reduced the peak corporate tax rate from 35% to 21%, the lowest since 1939. This change was designed to incentivize companies to increase investments in growth and innovation.

Corporate Buybacks Surge

In the wake of the TCJA, companies have significantly ramped up share buybacks. A report from S&P Dow Jones Indices highlighted that S&P 500 companies repurchased $249 billion of their own stock in the third quarter of 2025. This figure, while lower than the record of $293.5 billion set earlier that year, positions companies on track for total buybacks exceeding $1 trillion in 2025.

Leading Players in Share Repurchases

Among tech giants, Apple, Alphabet, and Nvidia have emerged as leaders in share repurchase activities. The following details highlight their buyback statistics:

- Apple: Since starting its buyback program in 2013, Apple has repurchased more than $816 billion worth of stock, reducing its share count by approximately 44%. In fiscal 2025 alone, Apple spent $90.7 billion on buybacks.

- Alphabet: The parent company of Google has bought back $342.4 billion worth of shares over the last decade. Given its dominant position in internet search and advertising, Alphabet continues to leverage its abundant cash flow for stock repurchases.

- Nvidia: Although Nvidia has repurchased $115.1 billion in stock over the last decade, it reached close to $52 billion in buybacks in the past twelve months alone, driven by growing demand for its GPUs.

Ongoing Trends and Future Outlook

While some uncertainties remain regarding trade policies and tariffs, the trend of significant corporate investments appears poised to continue. Trump’s tax policy has undeniably catalyzed a dramatic increase in share buybacks, encouraging companies to reward shareholders. The combination of this policy with technological advancements in AI demonstrates a dynamic interplay of factors driving the stock market forward.

As Wall Street navigates these developments, Trump’s influence on corporate America reflects a broader economic strategy that prioritizes growth, investment, and shareholder value in an evolving market landscape.