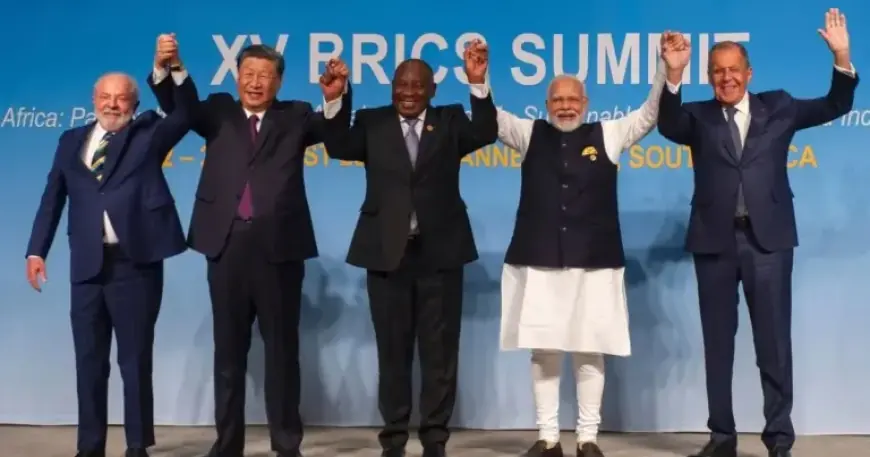

BRICS Nations Unite to Explore Digital Currency, Challenge Dollar Dominance

The BRICS nations are considering the introduction of central bank digital currencies (CBDCs) to facilitate cross-border trade and challenge the dominance of the US dollar. The Reserve Bank of India (RBI) has proposed this topic for discussion at the upcoming 2026 BRICS summit, which India will host.

BRICS Expansion and Digital Currency Initiative

Initially comprising Brazil, Russia, India, China, and South Africa, the BRICS group has expanded to include the United Arab Emirates, Iran, and Indonesia. The RBI’s proposal aims to create interoperability among member states’ national digital currencies, enhancing trade finance and tourism payments.

Current Status of CBDCs in BRICS Nations

- None of the major BRICS economies have fully launched a retail CBDC.

- All members are running pilot programs for their digital currencies.

- India’s e-rupee, launched in December 2022, has around seven million users.

- China plans to expand its digital yuan’s international usage.

Despite the absence of formal comments from the central banks of China, Brazil, and Russia, prospective discussions are vital for the potential adoption of CBDCs across BRICS nations.

Key Features and Challenges

The RBI is keen to link the e-rupee with other CBDCs. This initiative aims to boost efficiency in cross-border transactions while not signaling any direct move away from the dollar’s dominance. One of the core challenges is establishing technology standards, governance frameworks, and trade balance mechanisms for CBDCs.

- The RBI is exploring bilateral foreign exchange swaps between central banks.

- These swaps could facilitate weekly or monthly settlements, addressing trade imbalances.

Previous initiatives between India and Russia to increase trade in local currencies faced obstacles. Russia had accumulated substantial rupee balances with limited opportunities for use, pushing India to allow these funds to invest in local bonds.

RBI’s Perspective on Digital and Stable Coins

Amidst growing global interest in stablecoins, India maintains a cautious attitude. The RBI argues that stablecoins introduce significant risks to monetary stability. T Rabi Sankar, the RBI Deputy Governor, emphasized that CBDCs do not present many of these risks, highlighting concerns surrounding monetary control and systemic resilience.

As BRICS nations explore the possibilities of CBDCs, the landscape of international currency trade may be poised for substantial changes.