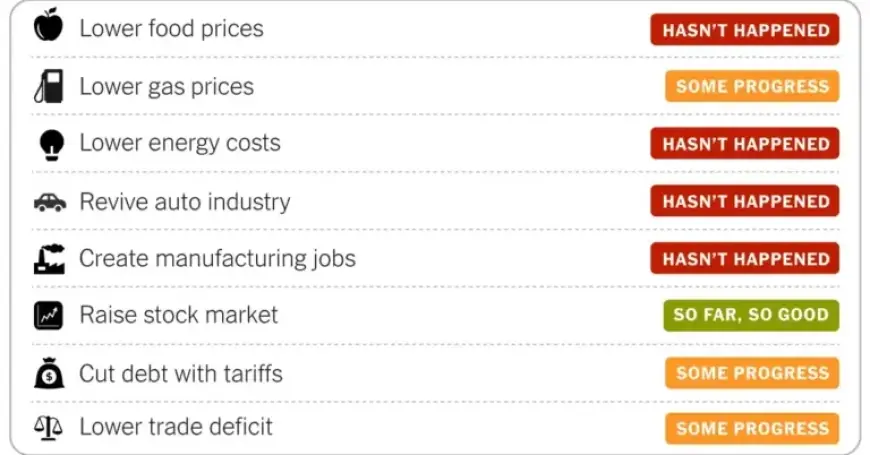

Assessing Trump’s Economy After One Year: Food Prices and Stock Market Insights

The economic landscape in the United States has been a focal point since President Trump’s return to office in 2024. Despite promises to tackle inflation, restore manufacturing jobs, and generate economic growth, significant challenges persist. This article examines Trump’s economic performance after one year, focusing on critical aspects like food prices and insights into the stock market.

Food Prices: Mixed Trends

One of Trump’s campaign pledges was to reduce food prices. Data indicates fluctuating trends in grocery costs. While prices for some categories, such as eggs, have decreased, costs for beef and other essentials have risen sharply. Overall, food inflation has lessened since the peak in 2022, yet recent price shifts have rekindled concerns:

- December marked the most significant one-month increase in grocery prices since 2022.

- Economists note that the promise of universally lower prices is challenging under the current economic framework.

- Tariffs on imported goods may have hindered further declines in food inflation.

Gas Prices: Not Reaching Promised Levels

Trump also vowed to bring gas prices below $2 per gallon. As of early January, prices averaged $2.78, a decrease from over $3 the previous year. Key factors affecting these prices include:

- Record highs of over $5 per gallon in 2022 due to geopolitical tensions.

- Domestic oil production, a significant driver of current price drops.

- Comparatively lower prices now reflect a five-year low.

Electricity Prices: Regional Disparities

Trump’s goal to halve electricity costs has not been realized. Currently, residential electricity prices are up by 6.7% year-over-year. Several regional differences impact consumer bills, influenced by:

- Increased demand from data centers associated with artificial intelligence.

- Rising energy costs becoming a crucial issue in political races.

The Auto Industry: Decline Continues

The U.S. auto industry has not shown signs of recovery during Trump’s administration. Manufacturing jobs in the sector have continuously declined, with approximately 28,000 jobs lost in the past year. Challenges faced include:

- Competition from foreign manufacturers, notably in the electric vehicle market.

- A lack of accelerated investment in domestic production capacities.

Manufacturing Jobs: Stagnation and Job Loss

Despite promises of revitalization, manufacturing employment has remained static initially, followed by eight straight months of decline. Key points include:

- Wage growth for factory workers has slowed significantly.

- Critics argue that the anticipated job recovery has yet to materialize.

Stock Market: Volatile Performance

Trump’s first year in office brought notable fluctuations in the stock market. After hitting a low with a nearly 18% slump, the S&P 500 closed up 16% over the year. Highlights include:

- Investor optimism about the artificial intelligence sector as a major market driver.

- Stock drops associated with tariff announcements, followed by rebounds when policies were relaxed.

Tariff Revenue: Significant Increases

Tariff revenues reached a record $264 billion in 2025, indicating a more than threefold increase from 2024. This realization reflects:

- Estimates predicting $2.5 trillion in additional revenue through 2035.

- The Supreme Court’s pending decisions on the legality of certain tariffs, which may influence future revenue.

Trade Deficit: Challenges Persist

Trump’s tariffs were intended to reduce the trade deficit. Initially, the deficit broadened as imports surged but later narrowed as companies adjusted to new policies. Considerations include:

- Ongoing uncertainty about whether domestic production will be relocated from overseas.

- Complexities in trade with China, where imports have been rerouted to evade tariffs.

Overall, while there are pockets of progress, the economic landscape remains complicated and turbulent as Trump’s administration navigates these challenges. As we look forward, the coming months will reveal more about the trajectory of the economy under his leadership.