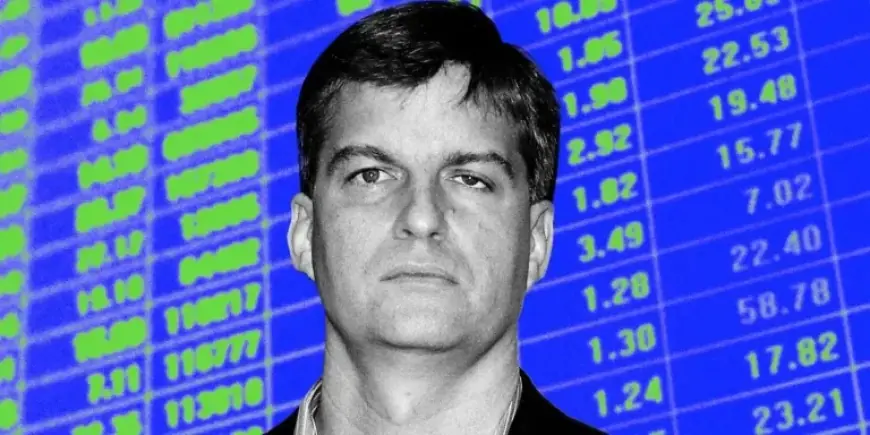

Michael Burry Uses Warren Buffett Anecdote to Justify AI Investments

Michael Burry recently expressed concerns regarding an impending AI bubble in a detailed exchange on Substack. The investor, known for his role in “The Big Short,” highlighted the potential ramifications of the current technology boom. His warnings centered around the massive investments made by tech giants in artificial intelligence infrastructure without a clear path to profitability.

AI Bubble Concerns Raised by Burry

Burry highlighted the excessive spending by large tech firms, including Microsoft and Alphabet. He cautioned that investments in microchips and data centers may not yield lasting benefits. Burry noted these AI tools, such as chatbots, are likely to become commoditized over time.

Warren Buffett’s Department Store Anecdote

To illustrate his point, Burry referenced a historical example involving a Baltimore department store previously owned by Warren Buffett, known as Hochschild-Kohn. He explained that both this store and a competing store followed each other in implementing costly upgrades, resulting in no significant advantage for either. Burry stated, “Neither benefited from that expensive project,” pointing out that a similar trend could be expected in AI implementations.

- Key Points:

- Trillions spent on AI with little expected return.

- Most companies will have no competitive advantage.

- Forecasted downturn in technology employment.

Predictions for the Tech Industry

Burry assessed that the tech sector is at a critical junction. He claimed that we are currently “past the point where stocks will reward investors for further buildout.” He expects that the costs associated with these technology investments will soon become evident, leading to a prolonged downturn in the industry.

Critique of Prominent AI Stocks

Burry expressed skepticism towards major AI stocks, specifically naming Nvidia and Palantir as companies he considers overvalued. He described Nvidia as the “power-hungry” solution but noted that it is merely holding the position until more efficient alternatives emerge. Burry also criticized Palantir’s CEO, Alex Karp, suggesting Karp’s responses indicated a lack of confidence in the company’s future.

Insights into the AI Boom

Burry shared several surprising revelations regarding the AI landscape. Firstly, he noted Google’s struggle to keep pace with emerging competitors, stating that it’s “mind-blowing” for Google to be playing catch-up. He also pointed out how ChatGPT ignited a massive infrastructure investment race among businesses.

Another surprise for Burry was Nvidia’s sustained dominance in the chip market. He anticipated that by now, more energy-efficient alternatives would have gained traction.

Real-World Applications and Concerns

Furthermore, Burry raised doubts about the notion of “AI-proof” job security in trade professions. He suggested that middle-class individuals might opt for AI assistance, like using Anthropic’s Claude chatbot when faced with costly services from technicians. Additionally, he expressed concern that reliance on AI could lead to a decline in essential knowledge among professionals in various fields, including medicine.

As discussions about AI continue to evolve, Burry’s insights serve as a cautionary reminder of potential pitfalls in navigating the technology landscape.