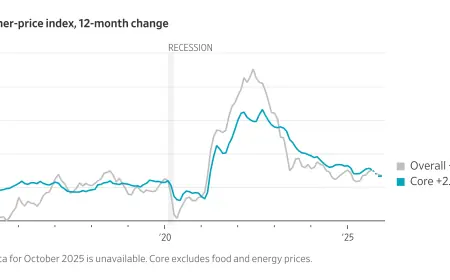

All eyes on CPI: Markets brace for pivotal inflation check at 8:30 a.m. ET

The latest Consumer Price Index lands at 8:30 a.m. ET, setting the tone for interest-rate expectations and risk sentiment. With rate-cut hopes contingent on steady disinflation, traders are fixated on whether core price pressures, especially in services, continue to ease or hold stubbornly firm.

Why this inflation print matters now

The cpi remains the market’s top catalyst because it shapes the path for policy. A cooler trajectory would bolster the case for rate cuts later this year, easing financial conditions and supporting growth-sensitive areas of the market. A hotter outcome, especially in the core measure that strips out food and energy, would underline stickier inflation and could push yields higher, weighing on equities and credit.

Beyond the headline number, the month-over-month pace is critical. Investors are watching whether the underlying trend coalesces around a steady 0.2%–0.3% monthly pace for core, or whether readings closer to 0.4% reappear, a level that complicates the final leg toward the inflation target.

Key swing factors inside CPI

Shelter: Rent and owners’ equivalent rent carry heavy weight and have been slow to cool in official data. Private rental indicators have softened over the past year; the question is how quickly that deceleration filters into the index. A clearer downshift in shelter inflation would meaningfully lower core pressure.

Auto insurance and repairs: Premiums surged over the past year amid higher repair costs and claims severity. Any moderation here could relieve an outsized driver of core services.

Core goods: Used cars, apparel, and household goods have been a mixed bag as supply chains normalized. Renewed discounting or inventory clearance would foster goods disinflation; conversely, firming demand could blunt that effect.

Travel and medical: Airfares, lodging, and medical-care services can be volatile month to month. Even small swings can alter the tone of the report, particularly if services ex-housing trends look sticky.

Energy and food: Gasoline moves can whipsaw the headline index. Food at home has cooled meaningfully from prior peaks, while food away from home remains firmer; any divergence will matter for household budgets and sentiment.

The thresholds that will steer the market narrative

- A tame outcome: A core monthly pace near 0.2%–0.3% would keep disinflation on track. In that scenario, Treasury yields typically ease, the dollar softens, and rate-sensitive sectors—tech, real estate, small caps—tend to catch a bid.

- A sticky outcome: A 0.4% or hotter core print would revive concern that services inflation remains entrenched. Yields could rise, compressing equity valuations, while defensive and cash-flow durable names might outperform. Rate-cut timelines would likely get pushed back.

- Mixed signals: A benign headline with a firm core—or vice versa—would shift focus squarely to shelter and services details. Markets often whipsaw at the open before settling as traders parse the internals.

Shelter slowdown watch: the lag that still matters

For months, one of the central debates has been the lag between real-time rental market cooling and the shelter components inside cpi. If owners’ equivalent rent and primary rent register a more decisive downtrend, the math of disinflation improves quickly. If they remain sticky, the overall index can look stubborn even as other categories ease. Watch the three-month and six-month annualized shelter pace for evidence of a durable turn.

Services ex-housing and wages

Services inflation outside of shelter has been closely linked to labor costs. Any fresh slowdown in categories like personal services and transportation services would suggest easing wage pressure is feeding through. If these categories surprise to the upside, it would challenge the notion that inflation is on a one-way path lower, even if goods prices continue to cool.

Methodology tweaks, seasonals, and other wild cards

Annual weight rebalancing, seasonal-factor updates, and healthcare adjustments can nudge the cpi’s month-to-month profile. While these changes usually fine-tune rather than redefine the story, they can still drive short-lived volatility at the open. Keep in mind that revisions to seasonal patterns can make year-ago comparisons look different from what traders grew accustomed to late last year.

Market setup heading into 8:30 a.m. ET

Positioning is tight around the release window, and liquidity can be thin in the first minutes after 8:30 a.m. ET. Expect swift moves in two-year and ten-year Treasury yields and a fast read-through to equity index futures. Beyond the initial reaction, the day’s tone often depends on whether the components corroborate a clear trend in core services and shelter. With the next policy decisions hinging on a few pivotal inflation prints, the stakes for this release remain high.